by RSM US LLP | Apr 15, 2024

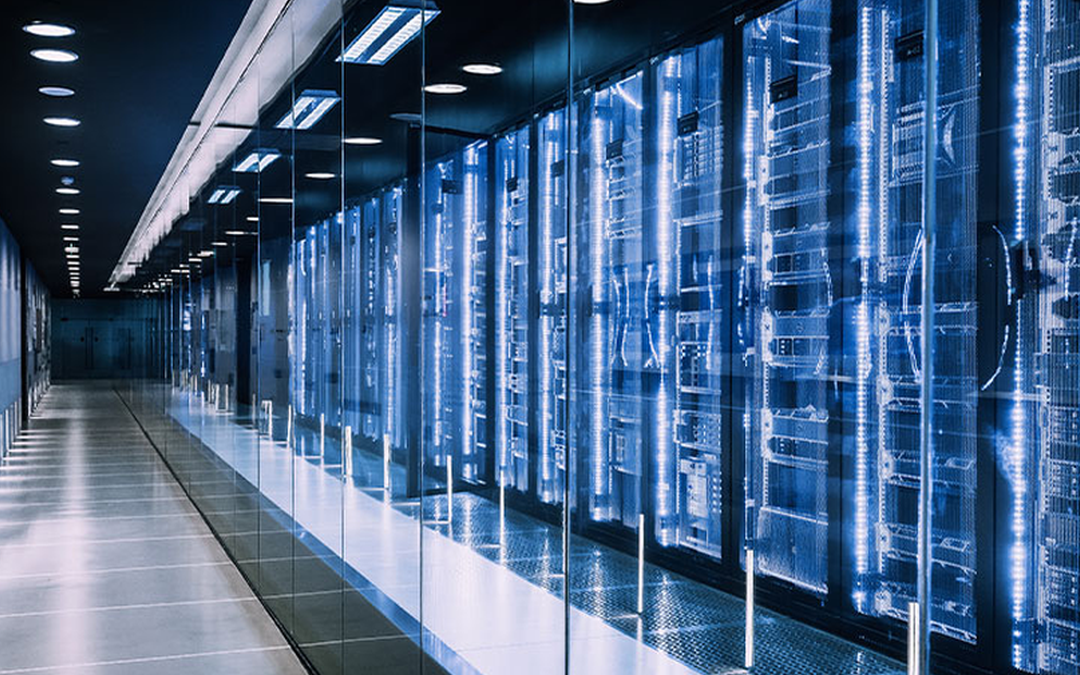

Insights We are proud to be named a West Coast Regional Leader for 2024 < Back to Insights and Resources A guide to IT modernizationGUIDE | April 15, 2024Authored by RSM US LLPOrganizations today are increasingly recognizing the imperative need to modernize their...

by RSM US LLP | Dec 19, 2023

Insights We are proud to be named a West Coast Regional Leader for 2024 < Back to Insights and Resources A guide to hedge accountingGUIDE | December 19, 2023Authored by RSM US LLPThis article was originally published in February 2017 and has been updated.Our...

by RSM US LLP | Dec 18, 2023

Insights We are proud to be named a West Coast Regional Leader for 2024 < Back to Insights and Resources A guide to lease accountingGUIDE | December 18, 2023Authored by RSM US LLPA guide to lease accounting under ASC 842 has been updated primarily to incorporate...

by RSM US LLP | Oct 16, 2023

Insights We are proud to be named a West Coast Regional Leader for 2024 < Back to Insights and Resources International tax year-end considerationsGUIDE | October 16, 2023Authored by RSM US LLPMore than five years have passed since the Tax Cuts and Jobs Act of 2017...

by RSM US LLP | Oct 16, 2023

Insights We are proud to be named a West Coast Regional Leader for 2024 < Back to Insights and Resources Year-end tax planning guide for individualsGUIDE | October 16, 2023Authored by RSM US LLPOn the horizon are several significant tax law changes affecting...

Recent Comments