Insights

We are proud to be named a West Coast Regional Leader for 2025

6 Manufacturing & Distribution Insights from Q4 2025 and What They Mean for You

ARTICLE | October 31, 2025

Authored by Aprio, LLP

This article was originally published by Aprio on October 29, 2025.

After a year of uneven growth, the manufacturing sector is showing signs of stabilization. Production is once again expanding, factory construction remains elevated, and new orders are beginning to outpace inventories — early signals of a potential rebound. Despite input costs and shifting trade dynamics, margins are holding steady. For manufacturers and distributors, the message this quarter is cautious optimism: seize the moment by prioritizing efficiency, controlling costs, and preparing for a gradual but steady recovery.

1. Signs of Stabilization in Manufacturing

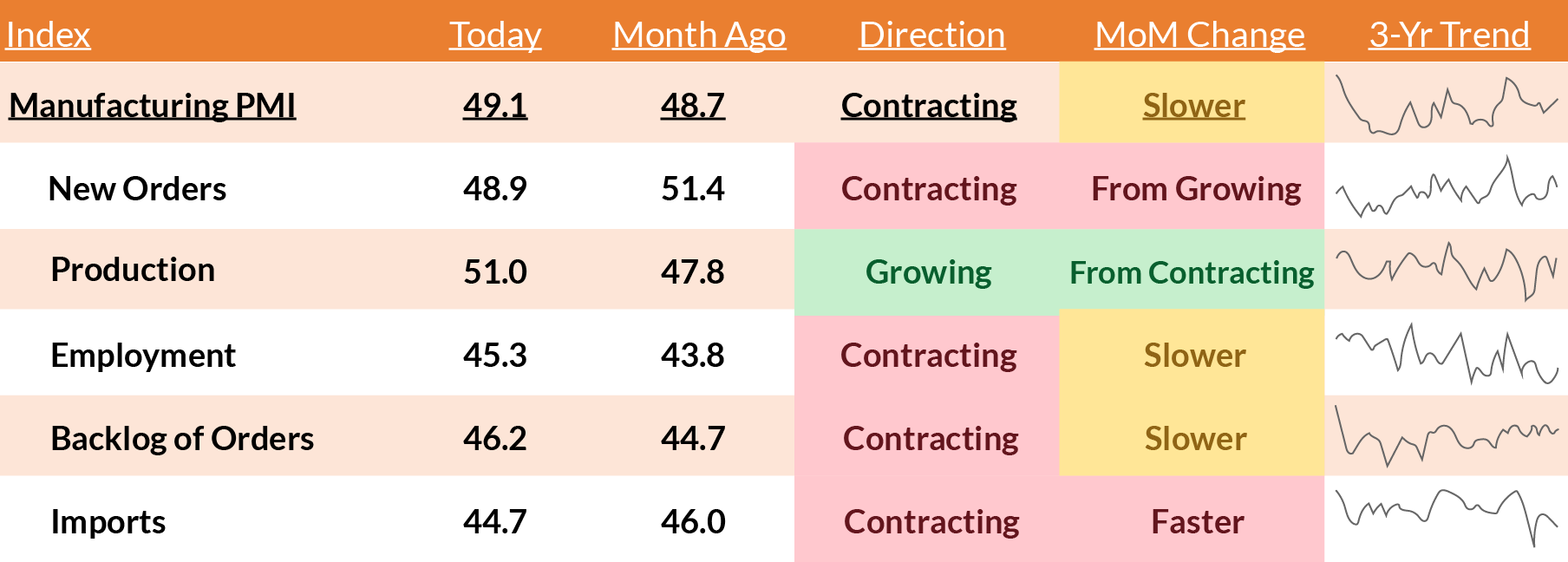

Source: Institute of Supply Management (ISM)

The Manufacturing PMI climbed to 49.1, marking its highest reading in six months and edging up from 48.7 last month. Production ticked into expansion territory at 51.0 for the first time since spring, signaling renewed momentum on the shop floor. While New Orders (48.9) and Employment (45.3) remained weak, both showed modest improvement. Imports are decelerating and backlogs are reducing at a gentler pace.

What this means for you: The sector may not be in full recovery yet, but the pace of the slowdown is easing. Factories are operating leaner, producing more with fewer employees, a testament to their history of resilience and adaptation. This is a critical time for business leaders to prioritize cash management, invest in productivity tools, and embrace automation. Staying agile will help capture growth opportunities when the increase in demand eventually picks up.

2. New Orders are Once Again Outpacing Inventories

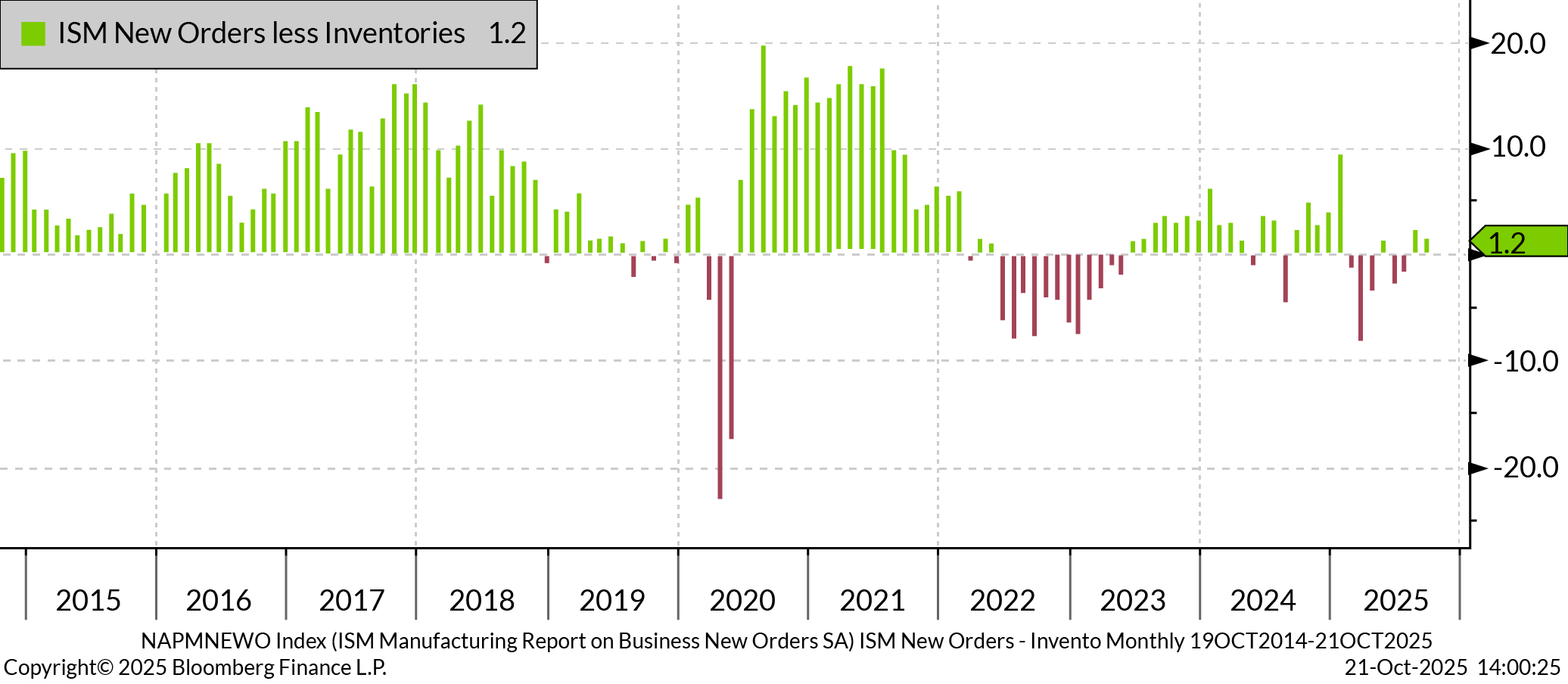

Source: Bloomberg Finance, LP

For the first time in over a year, the ISM “New Orders less Inventories” index has posted two consecutive months of positive readings. This improvement signals a subtle shift that new orders are now growing slightly faster than inventory levels, a pattern that has historically been a leading indicator of broader manufacturing recoveries by several months.

What this means for you:This shift is quiet but important. It sets the stage for excess inventory to clear up, and production to meet rising demand. Manufacturers should keep forecasts short-cycle but also begin to plan for selective restocking in faster-moving product lines. If sales continue to stabilize, 2026 could mark the start of a gradual expansion.

3. Navigating Mixed Signals from Input Costs

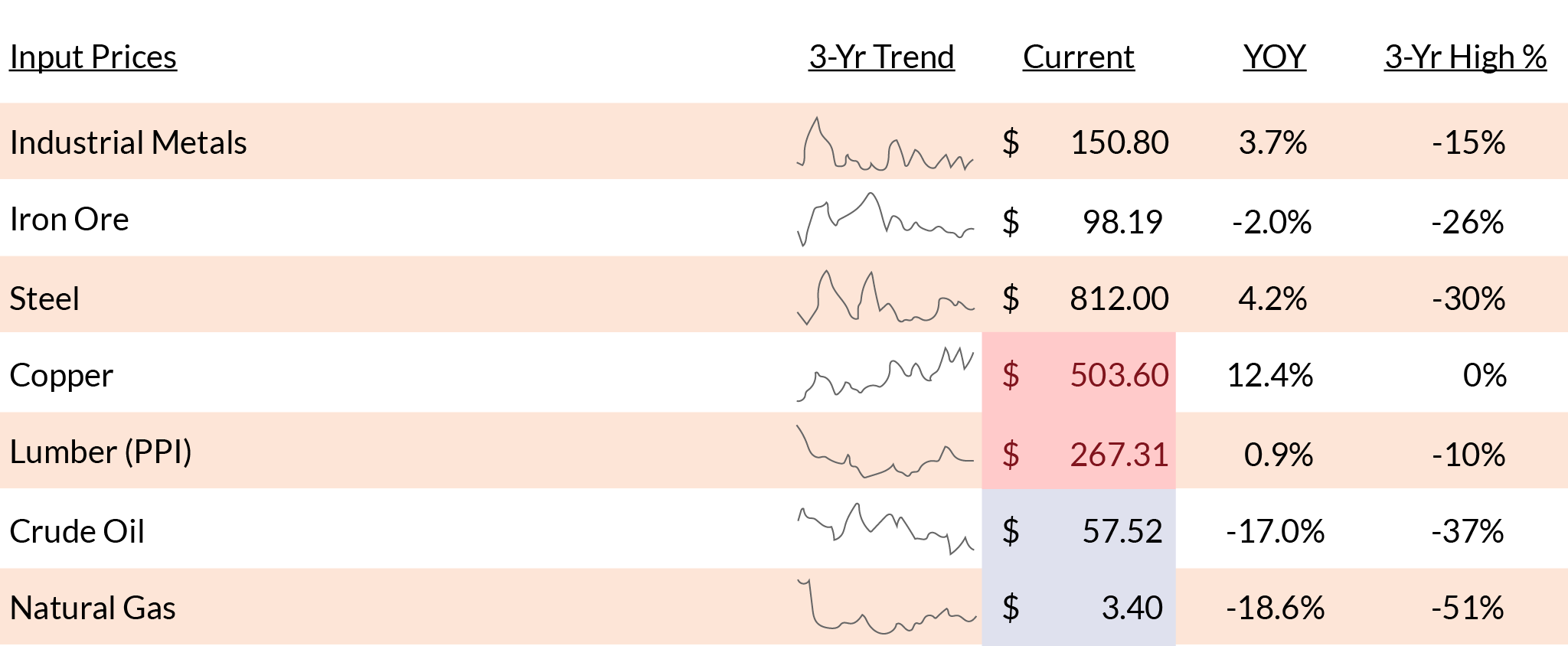

Source: Bloomberg Finance, LP

Commodity prices are sending mixed signals. Steel prices have climbed 4.2% year-over-year, and copper reached a historic high, driven by the anticipation of future demand from buildouts for AI, electrification, and re-shoring globally. In contrast, crude oil has declined more than 15%, reflecting weaker demand and robust supply as global growth slows and international production ramps up.

What this means for you: Material inflation hasn’t disappeared — it’s simply more selective. Manufacturers using steel and copper may face margin pressure, while those with energy-heavy production may benefit from the lower oil and gas costs. This divergence underscores the need for more granular cost planning strategies, such as hedging key inputs and locking in favorable energy contracts while volatility remains muted.

4. Factory Construction Remains Strong, but Pace is Easing

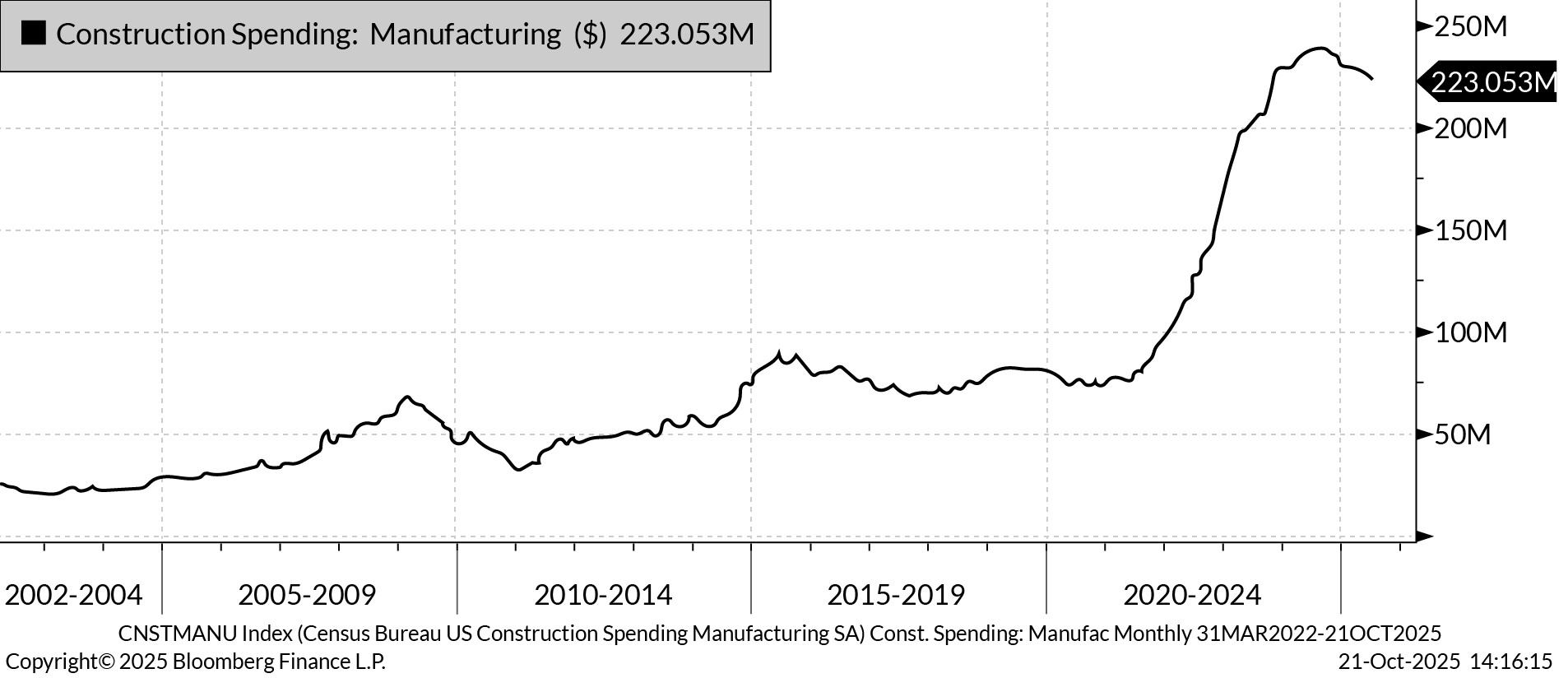

Source: Bloomberg Finance, LP

Spending on the construction of manufacturing facilities sits at $223 billion, still near record levels but easing from its recent highs. The surge, driven by reshoring, clean energy, and EV-related investment, is now leveling off as projects move from build-out to production.

What this means for you:The building boom is maturing and likely decelerating. Companies are focusing more on optimizing and operating new facilities over construction. Those considering expansion may benefit from competition for resources, even as borrowing costs may remain elevated, potentially opening opportunities to capture additional market share.

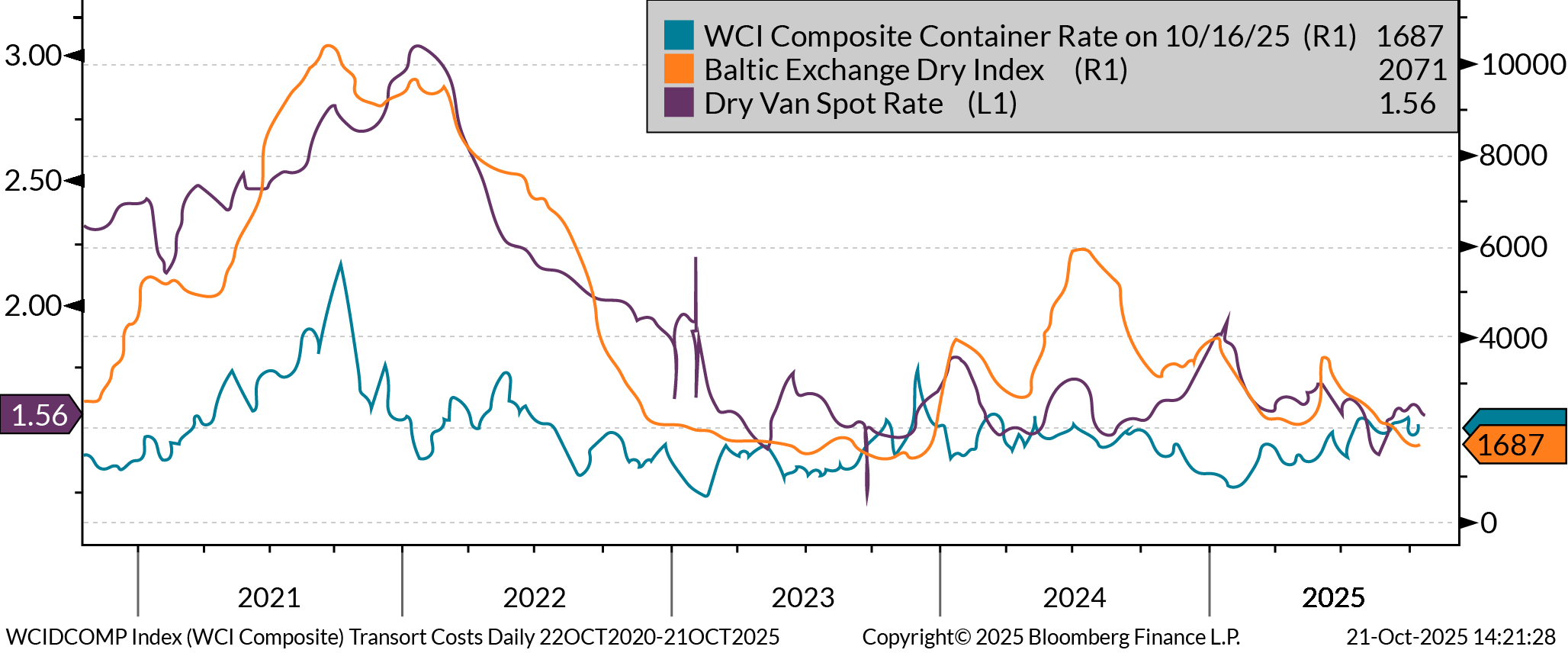

5. Freight Rate Divergence Reflects Uneven Demand

Source: Bloomberg Finance, LP

Freight markets are moving in different directions. The WCI Composite Container Rate has dipped from its mid-year highs, reflecting softer demand for goods shipped from Asia, potentially due to tariffs. Meanwhile, the Baltic Exchange Dry Index has climbed, signaling stronger global demand for bulk raw materials, such as iron ore and coal. The Dry-Van Spot Rate remains above pre-pandemic levels but is off its 2025 highs as domestic freight volumes stabilize.

What this means for you: Transportation costs mirror the economy’s mixed signals. Lower container rates reduce import costs, while rising bulk rates suggest steady global industrial activity in key commodities. For most manufacturers, this means importing materials could become cheaper even as export logistics slightly tighten. With domestic distribution holding steady, manufacturers should balance overseas sourcing with regional suppliers to manage costs and reduce exposure to global freight volatility. Diversifying logistics partners may help mitigate further volatility.

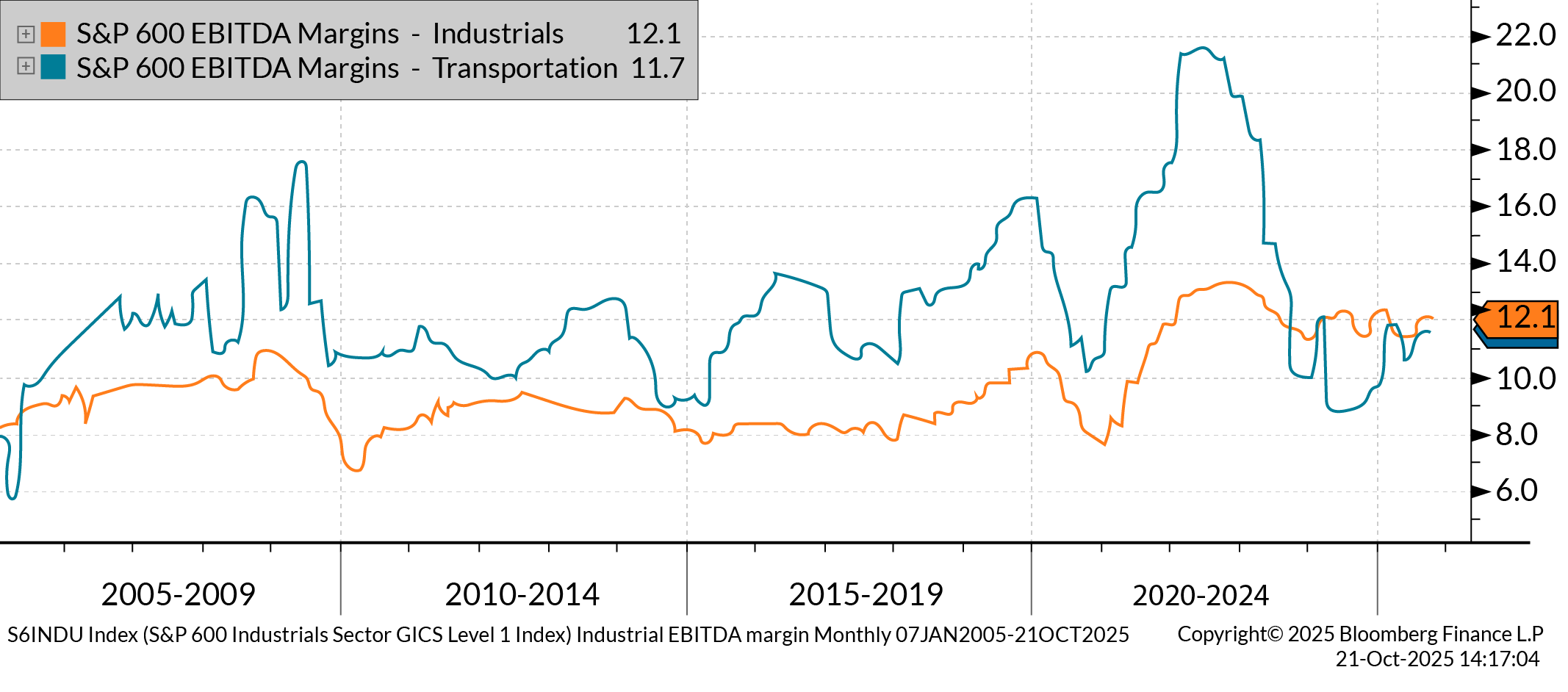

6. Margins Hold Steady Amid Cost Pressures

Source: Bloomberg Finance, LP

EBITDA margins for S&P 600 Industrials (12.1%) and Transportation (11.7%) remain stable over the past quarter. Both sectors are navigating the economic environment through disciplined cost management as they wait for margins to expand once demand sustainably grows.

What this means for you: Stability beats contraction — but staying profitable will require vigilance. With pricing power fading and costs diverging by input category, manufacturers need to focus on operational efficiency, disciplined pricing, and automation payback analysis. Every basis point of margin counts as the industry navigates 2026’s uncertain policy and trade environment.

Please connect with your advisor if you have any questions about this article.

Let’s Talk!

You can call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we’ll contact you to discuss your specific situation.

Required fields are marked with an asterisk (*)

This article was written by Aprio and originally appeared on 2025-10-29. Reprinted with permission from Aprio LLP.

© 2025 Aprio LLP. All rights reserved. https://www.aprio.com/6-manufacturing-distribution-insights-from-q4-2025-and-what-they-mean-for-you-ins-article-md/

“Aprio” is the brand name under which Aprio, LLP, and Aprio Advisory Group, LLC (and its subsidiaries), provide professional services. LLP and Advisory (and its subsidiaries) practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. LLP is a licensed independent CPA firm that provides attest services, and Advisory and its subsidiaries provide tax and business consulting services. Advisory and its subsidiaries are not licensed CPA firms.

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Vasquez + Company LLP has over 55 years of experience performing audit, tax, accounting, and consulting services for nonprofit organizations, governmental entities, and private companies. We are ranked among the top 1% of accounting firms by the AICPA and deliver tailored solutions that meet the unique needs of each client.

For more information on how Vasquez can assist you, please email solutions@vasquezcpa.com or call +1.213.873.1700.

Subscribe to receive important updates from our Insights and Resources.