Insights

Conditions Ripe For Services Firms To Make Strategic Investments

ARTICLE | March 03, 2021

Authored by RSM US LLP

Digital transformation can fast-forward operational improvements

Historically low interest rates are providing a rare opportunity for many businesses in the pandemic-depressed economy to access low-cost capital and make long-term strategic investments in technology and other improvements such as upgrades to their facilities, writes RSM US Chief Economist Joe Brusuelas.

Business and professional services firms are no exception.

Opportunities for professional services firms

Professional services firms have ridden the pandemic wave to unexpectedly positive results. But firms shouldn’t rest on their laurels as their peers increase investment across the board, even in the face of pricing pressures and threats of increased expenses.

With opportunities ranging from strategic realignment and transformation to cloud-based platforms, inexpensive capital affords professional services firms the chance to get ahead in what promises to be a hypercompetitive post-pandemic environment.

Strategic investment

Professional services firms will be forced to examine every aspect of their operational strategy:

- Real estate: Most firms are stuck in long-term leases for office space. So, considering how the workforce’s needs are changing and how clients are demanding remote accessibility, firms should look to transition excess square footage into more functional space, such as technology/innovation centers to provide solutions for more efficient and effective service.

- Workforce solutions: Many firms have enabled employees to work remotely, which has loosened geographic constraints to candidate pools. Now, firms should take advantage of this time to redesign compensation plans and benefit offerings (including funding of defined benefit plans) to increase recruitment and retention of talent. In addition, firms must revisit their diversity strategy and aim to align themselves with solutions that shape the diversity of their workforce.

- Firm alignment: Clients’ needs have continued to change through the pandemic. Professional services firms should innovate the way they serve clients and go to market in order to position themselves as industry experts. This challenges the long-held status quo of practice group alignment; however, clients demand trustworthy advisors that understand their business and the sector in which they operate.

- Growth (organic and inorganic): Professional services firms should look at their plan for geographic expansion, accounting for expanding markets, acquisitions and identification of top-level talent in nonoffice locations. Other components of growth strategy include identification and execution of lateral hiring, as well as applying a growth mindset to nurturing rising star employees. This would allow firms to grow revenues even with clients continuing to challenge increasing rates.

In a traditionally slow-changing sector, these strategic decisions can help a firm gain a competitive advantage in the marketplace.

Technology investment

- Professional services firms need to rethink and redesign many of their processes, and they need to do it now. Some firms adapted quickly to the pandemic, and some didn’t. But even those that reacted quickly need to sustain, fortify and expand those efforts. This takes investment in technology and resources to support the technology.

- As cloud solutions adapt to the sector’s unique information technology and security requirements and business problems, customers are looking to partners who have proven expertise in their industry and can bring customized intellectual property solutions to hit the ground running. This is especially important when it comes to artificial intelligence/machine learning, robotic process automation and data analytics.

Refinancing

Many professional services firms have lines of credit that are utilized periodically throughout the year during periods of low cash collections. Many firms were able to take advantage of low financing rates during the pandemic to restructure their lines and possibly expand their liquidity under the lines of credit. However, as investment decisions are made, firms should be able to benefit from lower financing rates.

Why invest now?

In recent years, middle market firms have lagged behind their larger industry counterparts in capital outlays, a trend that has been documented in the RSM US Middle Market Business Index. In an encouraging sign, the December 2020 MMBI survey showed that more than half of respondents (52%) said they expect to boost investment in productivity-enhancing capital expenditures such as software, equipment and IP over the next six months.

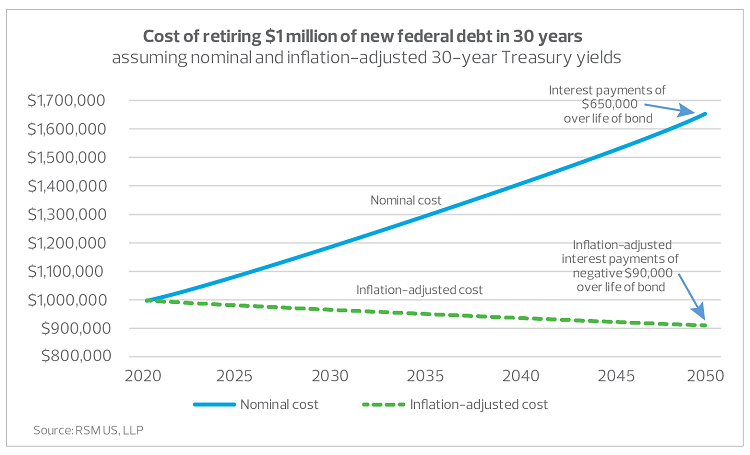

“Due to the unique confluence of events that is upon us,” writes Brusuelas, “firms will actually make money by borrowing, because we are operating at near-zero nominal interest rates that become negative when adjusted for inflation.”

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Michael Gerlach and originally appeared on Mar 03, 2021.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/professional-services/conditions-ripe-for-services-firms-to-make-strategic-investments.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.