Insights

We are proud to be named a West Coast Regional Leader for 2024

ESG, real estate and a long-term strategy

ARTICLE | July 21, 2021

Authored by RSM US LLP

As public pressure builds for industries to adhere to environmental, social and governance (ESG) standards, the real estate and construction industries are no exception. The European Union has passed many regulations that require proper ESG planning and disclosures for real estate businesses. By contrast, ESG investing in the United States and Canada is resulting more from public pressure than from regulation. Investors globally are watching ESG developments closely.

One of the largest environmental considerations for real estate investors relates to the goal of carbon neutrality. Decarbonizing new and existing buildings has been a critical focus of the Paris Agreement. The United Nations Sustainable Development Goals within the sector demonstrate that residential and commercial buildings are responsible for nearly 40% of energy and process-related emissions, according to studies conducted by the Environmental and Energy Study Institute. Because concrete used in development remains a significant source of carbon emissions, the responsibility for carbon emissions reduction will continue to be a strong focus for commercial real estate. Building stock is set to double by 2050, according to projections included in the 2018 Global Status Concrete Report on buildings and construction.

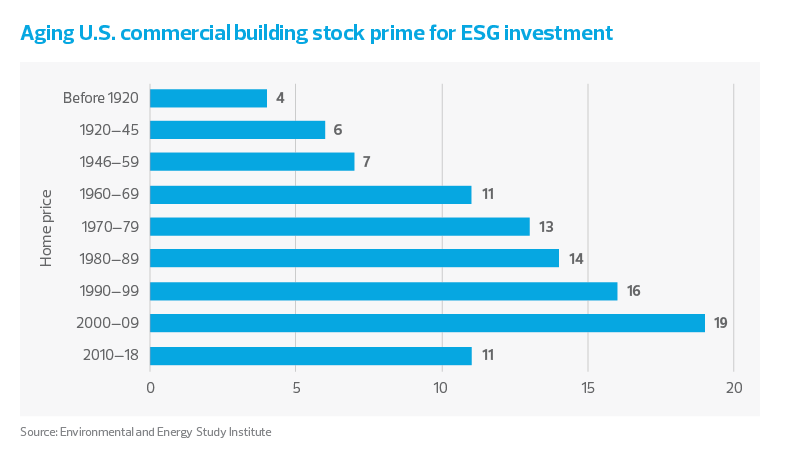

In the United States, the Biden administration has an opportunity to enact a robust environmental agenda likely to gain bipartisan support—the question is not if, but when, policy will be enacted. A primary goal of the infrastructure plan expected to be passed later this year is reducing climate change; the private sector is already pushing for sustainability amid increasing pressure from investors. The real estate and construction sectors, along with society as a whole, stand to benefit from government credits and incentives meant to spur investment in energy-efficient infrastructure and buildings. One such example is the E-Quip Act, a bill recently introduced in the House that aims to provide assistance for expensive retrofits of aging and obsolete HVAC, lighting, windows, roofing and the like with state-of-the-art systems; it offers 10-year accelerated depreciation on new equipment in commercial and multifamily buildings. E-Quip promises to be a catalyst that will add jobs, promote energy savings and significantly reduce carbon emissions. If passed, this legislation has been estimated to save 100 million tons of CO2 emissions, or the equivalent of taking 22 million cars off the road for one year, according an analysis by the American Council for an Energy Efficient Economy (ACEEE). With over half of commercial real estate buildings constructed before 1989, the industry stands ready for a major environmental face-lift.

In addition to the new administration’s appetite for a federal environmental agenda, many states and cities have established energy benchmarking policies for publicly owned buildings. And it may not be long before such requirements reach private investment. Leading jurisdictions like New York City, Seattle, Washington, D.C., and Boston have already adopted transparency rules for the private sector, with some passing laws that require owners of existing buildings to make efficiency improvements. Legislative requirements aside, the ESG Dashboard of Nareit, the group that represents the interest of REITs, shows that nearly all (98%) of the 100 largest REITs were reporting sustainability efforts in 2020, up sharply from 60% in 2017. Carbon emissions aren’t the only target: REITs are reporting on carbon emissions, energy and water usage, and waste management.

Social initiatives, while harder to quantify, are now tied to financial metrics and considered crucial for employee and tenant retention at both commercial and residential properties. Internally, workforce programs are vital to attract and retain employees. Health and wellness programs contribute significantly to an employee’s overall engagement to the business. Real estate developers also have a responsibility to consider the overall community during construction. Collaborative spaces like rooftop terraces or parks connect tenants to the property and their neighbors, fostering community and wellbeing, while reducing the likelihood of turnover.

MIDDLE MARKET INSIGHT

Social initiatives, while harder to quantify, are now tied to financial metrics and considered crucial for employee and tenant retention at both commercial and residential properties.

Corporate governance involves a delicate balance of the interests of a company’s shareholders, executives, customers, supply chain and overall community. Nasdaq’s recent push to potentially require listed companies to have women or members of an underrepresented group on a listed company’s board is consistent with requirements already in place in many European countries. Goldman Sachs additionally committed to only underwriting IPOs in the United States and in Europe for companies with at least one diverse board member in 2020 and two in 2021, further highlighting the focus on diversity and its importance to the public markets. It’s clear that a culture of diversity and inclusion, and the varying perspectives and backgrounds it brings, is essential for sound corporate decisions.

ESG considerations will become even more vital in the coming years for all types of real estate and construction companies as strategies with ESG focus continue to attract institutional investors such as pension funds with ESG mandates.

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Laura Dietzel and originally appeared on Jul 21, 2021.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/real-estate/esg-real-estate-and-a-long-term-strategy.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.