Insights

We are proud to be named a West Coast Regional Leader for 2024

Estate planning Q&A: Sales to Intentionally Defective Grantor Trusts explained

ARTICLE | July 09, 2024

Authored by RSM US LLP

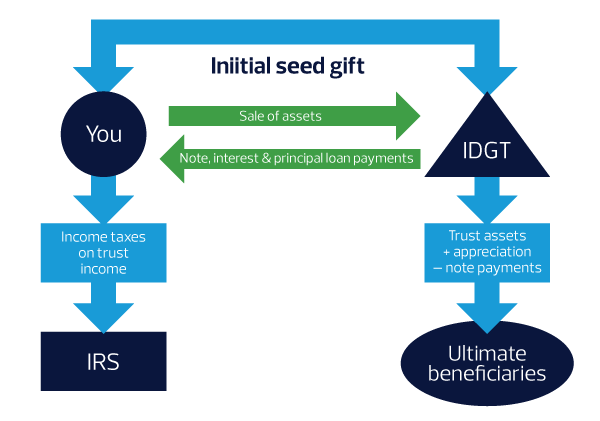

Despite the name, Intentionally Defective Grantor Trusts (IDGTs) are not necessarily ‘defective’ when it comes to your estate plan. In fact, IDGTs can be an incredibly useful and valuable estate planning vehicle. By strategically selling assets to an IDGT, you can potentially reduce your taxable estate and provide long-term benefits for your family.

What is an IDGT?

See our related article Estate Planning Q&A: Gifting to Intentionally Defective Grantor Trusts explained to understand the basic structure of an IDGT and how to make a traditional gift to your IDGT. This article discusses selling assets to your IDGT. The transaction is structured much like any other sale. You sell assets to the IDGT in exchange for a promissory note equal to the fair market value of the assets. This removes the assets from your taxable estate and replaces them with the note, essentially ‘freezing’ the value included in your estate. For example, you sell an asset with a fair market value of $5M to your IDGT in exchange for a $5M note. The asset grows outside of your estate to a fair market value of $10M. The asset appreciates outside of your estate, but only the $5M value of the note is included in your estate.

Because an IDGT is not considered separate from you for income tax purposes, the sale transaction is generally disregarded. When appropriately structured, a sale to an IDGT can transfer wealth to future generations without triggering transfer taxes or income taxes.

What are the requirements for selling assets to an IDGT?

- The fair market value of the asset(s) sold to the IDGT at the time of the sale must be determined, which may require an appraisal.

- Before the sale, the IDGT should be funded with a “seed gift.” It is generally recommended that the seed gift is at least 10% of the value of the asset(s) that will be sold and consist of cash or other liquid assets.

- The interest rate of the promissory note must be equal to or exceed the applicable federal rates, or AFRs, specified by the IRS at the time of the sale.

- The loan must be secured, typically by the assets transferred to the IDGT.

- The life of the loan cannot exceed your life expectancy.

- The loan terms should require regular payments due from the IDGT.

- The loan terms must be properly documented in writing.

What are the benefits of selling assets to an IDGT?

- The amount of assets you sell to the IDGT is not limited by the lifetime gift exemption, other than ensuring the seed gift is appropriate.

- The interest income you receive back from the IDGT as a result of the promissory note payments is not taxable income to you during your life.

- The sale of assets to the IDGT will not give rise to income tax on capital gains.

- If a professional appraisal is required, the asset’s fair market value may be discounted, which would allow more appreciation to escape future estate taxes.

- If the above requirements are met, the loan terms can be fairly flexible to meet your needs, for example, the loan could require interest only payments during the life of the loan, with a balloon principal payment at the end of the loan term.

What are the potential downsides of selling assets to an IDGT?

- If you die before the expiration of the loan, the remaining balance on the loan at the time of your death will be included in your estate.

- If the asset(s) sold to the IDGT do not appreciate faster than the applicable federal rate (AFR) interest rates used (or even lose value), you will have actually increased the value of your estate since the payments you receive back from the IDGT will exceed the value of the asset(s) removed from your estate by way of the sale.

- To help maximize the benefits of the sale, the IDGT must be able to generate enough cash from the trust assets to make the interest and principal payments required by the promissory note.

- A professional appraisal, if required, would add additional expense and time to the transaction.

Is an IDGT right for you?

Selling assets to your IDGTs can be a valuable and flexible way to transfer wealth with minimal to no tax consequences. If you anticipate your net assets exceeding the lifetime gift tax exemption, making a sale to an IDGT could be the right strategy for you. By understanding the requirements, advantages, and potential downsides, you can make an informed decision about whether an IDGT is right for your estate planning needs. As always, consult with your tax advisor to tailor a strategy that best suits your situation and goals.

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Scott Filmore, Ashley Pye, Amber Waldman and originally appeared on 2024-07-09. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/services/business-tax/sales-to-intentionally-defective-grantor-trusts-explained.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.

Vasquez + Company LLP has over 50 years of experience in performing audit, tax, accounting, and consulting services for all types of nonprofit organizations, governmental entities, and private companies. We are the largest minority-controlled accounting firm in the United States and the only one to have global operations and certified as MBE with the Supplier Clearinghouse for the Utility Supplier Diversity Program of the California Public Utilities Commission.

For more information on how Vasquez can assist you, please email solutions@vasquezcpa.com or call +1.213.873.1700.

Subscribe to receive important updates from our Insights and Resources.