Insights

Government contractors face increased regulations and scrutiny in a competitive market

ARTICLE | April 24, 2023

Authored by RSM US LLP

Government contractors must ensure that they stay compliant with heightened regulations.

The U.S. government has written some large checks lately—for COVID-19 relief, infrastructure investment, Ukraine aid and the fiscal year 2023 omnibus budget package. The government has outsourced execution of many of these initiatives to contractors, and will continue to do so. But Washington wants taxpayers to know their tax dollars are stewarded well. An emphasis on public trust means heightened regulations for government contractors as contracts are awarded and funds are disbursed. Contractors cannot lose sight of these requirements as they compete in a consolidating industry that may start courting new entrants looking to get in on the action.

False Claims Act

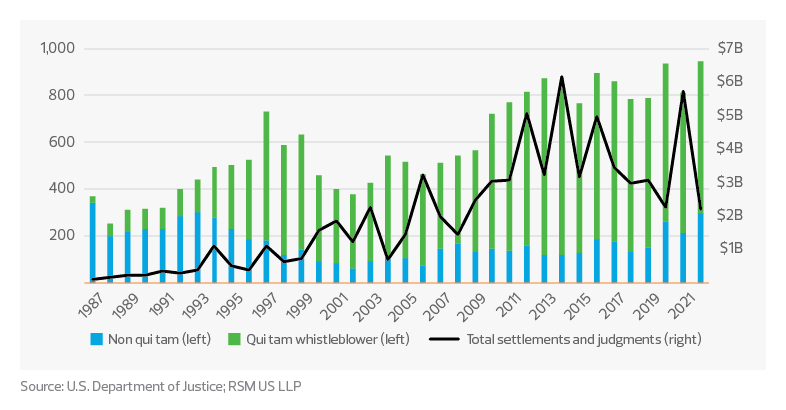

Settlements and judgments under the False Claims Act exceeded $2.2 billion in government fiscal year 2022. The government and whistleblowers were party to 351 settlements and judgments, the second-highest number in a single year. We expect the upward trend in FCA investigations to continue, considering the flurry of large spending bills enacted recently and the administration’s desire to ensure appropriate stewardship of taxpayer dollars.

The FCA is the primary tool the government and private citizens use to prevent and prosecute fraud via financial penalties and debarment. The lion’s share of FCA cases have historically related to health care, such as Medicaid and Medicare fraud, unnecessary service and substandard care, drug pricing, and unlawful kickbacks.

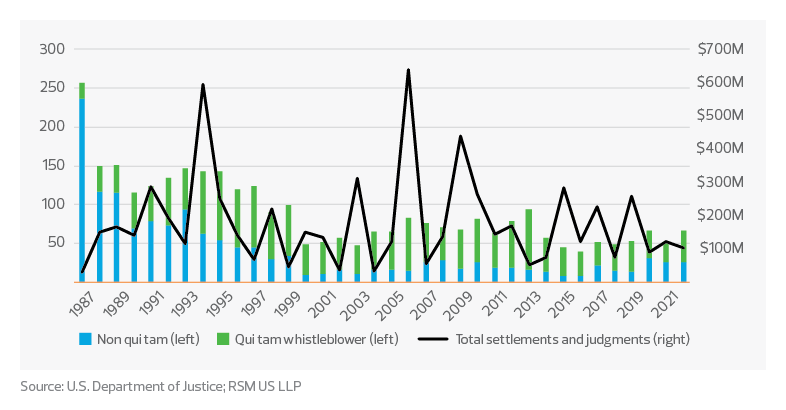

U.S. Department of Defense-related case counts—only 7% of total FCA cases in fiscal year 2022—have been much lower over the past 20 years than they were in the 1980s and 1990s. DOD-related FCA cases often relate to progress payment fraud, nonconforming materials, cost mischarging and defective pricing.

False Claims Act cases–U.S. Department of Defense

However, there is a new concern on the horizon related to cybersecurity. As the government boosts its standards (e.g., with Cybersecurity Maturity Model Certification), we expect to see claims rise for falsifying cybersecurity certifications, knowingly providing deficient products or services, and violating requirements related to monitoring and reporting incidents and breaches.

The U.S. Department of Justice launched its Civil Cyber-Fraud Initiative in October 2021. This program uses the FCA to prosecute government contractors for fraudulent acts related to cybersecurity. The government announced the first settlement under this initiative—for $930,000—in February 2022.

Contractors must ensure their internal controls, cyber hygiene and compliance processes are sufficient, up to date, well documented and well executed. Even longtime stalwarts of the industry cannot assume that what has worked in the past will be sufficient going forward. A deep understanding of new standards and a refresh of tools and processes will be critical for all.

Bid protests

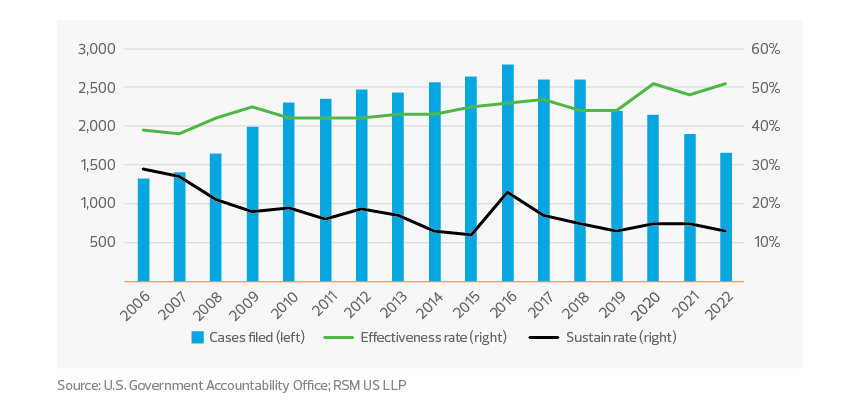

The U.S. Government Accountability Office released fiscal year 2022 bid protest statistics in its annual report to Congress last November. Award delays caused by bid protests are often a top complaint from executives in the ecosystem.

After a long period of steady increases, the bid protest case count has declined each year since 2018. This should be good news for contractors trying to manage the cash flow expectations of shareholders, private equity investors, program managers, subcontractors and hiring teams. However, the effectiveness rate of protests peaked at 51% in 2020 and 2022.

Annual GAO bid protest statistics

According to the GAO, unreasonable technical evaluation, flawed selection decision and flawed solicitation were the most common reasons for sustaining protests in fiscal year 2022.

We recommend contractors go above and beyond to prepare compliant and data-driven proposals that can withstand protest. Additionally, contractors should encourage their federal customers to align criteria in a way that promotes technical capability, deep knowledge of the customer, and a realistic view of what is needed to execute in terms of personnel, technology and cost.

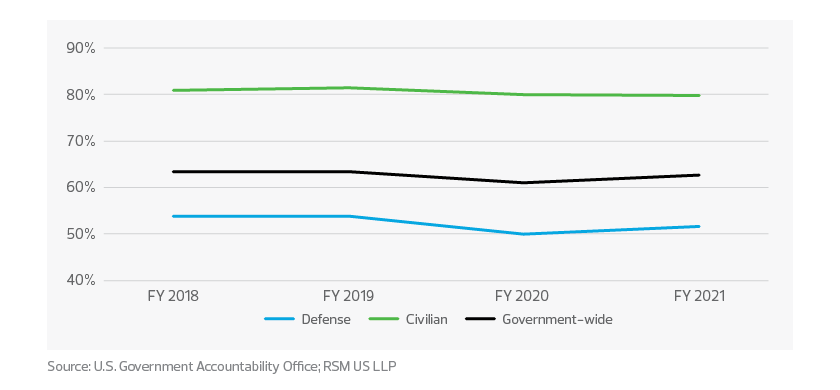

Competition

A key differentiator of the government contracting ecosystem is the customer’s ability to control the competitive environment. On one hand, the government limits competition to support small businesses and disadvantaged groups via set-aside contracts. On the other hand, many large businesses are protected from competition via sole-source contracts. The GAO releases annual data summarizing the competition rate for government-wide, defense and civilian contracts.

Percentage of competitive contract awards

Noncompetitive contracts can be risky to the government because there is no direct market comparison to help set the price. However, some products and services are so specialized that replacing a longtime provider is not possible or practical. Consider providers of large weapons systems with long lives that require extensive maintenance and training over time. A similar phenomenon could arise in the future as contractors provide tools and services underpinned by large data sets. Owning the underlying data rights gives the contractor staying power. If the government demands data rights, will creators of intellectual property be sufficiently motivated to engage?

The competition rate for government contracts influences every business serving or looking to serve the federal government. Understanding the competitive environment affects the strategic direction of contractors (i.e., which agencies to serve and which vehicles to pursue). It also affects bid-and-proposal expenses to sustain current contracts or gain access to new ones. There is a more level playing field within civilian markets. In contrast, a sizable portion of DOD awards are not competitive. However, the DOD has always had the largest purse, which is unlikely to change considering today’s threat environment.

Looking ahead for government contractors

Federal government contractors all share the challenges of operating in a highly regulated environment. What differs is how they choose to differentiate, where they focus investment, and how efficiently and effectively they maintain compliance.

New entrants must ask if they are ready for this level of regulatory compliance. Do they have the right experts to help weigh the compliance requirements against the related opportunity? If not, acquiring an experienced business may be worth considering.

Industry veterans must ask if their business is agile enough to innovate while maintaining higher security and compliance standards. What can they do to align their interests with their government customers to limit competition in their corner of the ecosystem?

Whether a company is tenured or is new to the game, one thing holds true: Robust internal controls, increased cyber hygiene, and thorough documentation around large awards or those requiring public trust are paramount. With great opportunity comes great responsibility.

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Stephanie Smith and originally appeared on Apr 24, 2023.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/government-contracting/contractors-face-increased-regulations-and-scrutiny-in-competitive-market.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.