Insights

Growth, employment and identifying the end of a business cycle

PERSPECTIVE | May 02, 2023

Authored by RSM US LLP

U.S. economic growth during the first quarter most likely reached 2.35% based on our RSM forecast, in contrast with the 2% estimated by other sources.

This growth, though, is not likely to last. Given the emerging consensus among other economists that the economy will fall into a recession this year, a discussion around identifying the end of the business cycle is in order.

RSM now forecasts a 75% chance of a recession over the next 12 months, an increase over our previous estimate of a 65% probability in the second half of the year. This change has been driven by the likelihood of tighter lending standards following the recent turmoil in the banking sector.

This higher probability of a recession follows a period of strength in the economy. If anything, the R word that should be used in connection with the American economy should be resilient, not recession. That nearly two years of elevated inflation and interest rate increases have not resulted in a recession by now is something to be analyzed and understood.

Yet that resilience appears to be giving way. The Federal Reserve’s rate hikes are starting to pull down growth just as tighter lending will probably cool the economy further over the next few months. The risks of a recession despite that resilience cannot be discounted.

The business cycle

The current business cycle will most likely go down as one of the shortest in American history.

In three years, the economy has gone from a health-crisis shutdown to a rapid recovery to a monetary policy-induced slowdown.

While it’s up to the National Bureau of Economic Research to identify the peak and trough of each business cycle after the fact, it’s equally important for businesses and households to analyze economic crosscurrents so they can plan for what’s ahead.

Let’s start with the NBER’s definition of a recession, which involves a significant decline in economic activity that is spread across the economy and lasts more than a few months. It treats three criteria—depth, diffusion and duration—as somewhat interchangeable in its analysis.

It is quite clear that the real estate sector—another area of the economy sensitive to interest rates—has been in recession for some time.

The most recent example is the plunge in economic activity during the pandemic, which lasted for two months and overwhelmed the NBER’s traditional criteria of a recession.

In contrast, the negative growth in two consecutive quarters at the start of 2022 was not identified by NBER as a recession, primarily because it did not occur contemporaneously with a broad-based decline in employment and real final sales.

The NBER looks at several indicators to identify the chronology of a business cycle, including:

- Real personal income less transfers

- Nonfarm payroll employment

- Employment as measured by the household survey

- Real personal consumption expenditures

- Wholesale and retail sales adjusted for price changes

- Industrial production

It’s important to note the NBER’s finding that the economy is usually expanding. Recessions occur, but they are usually short-lived.

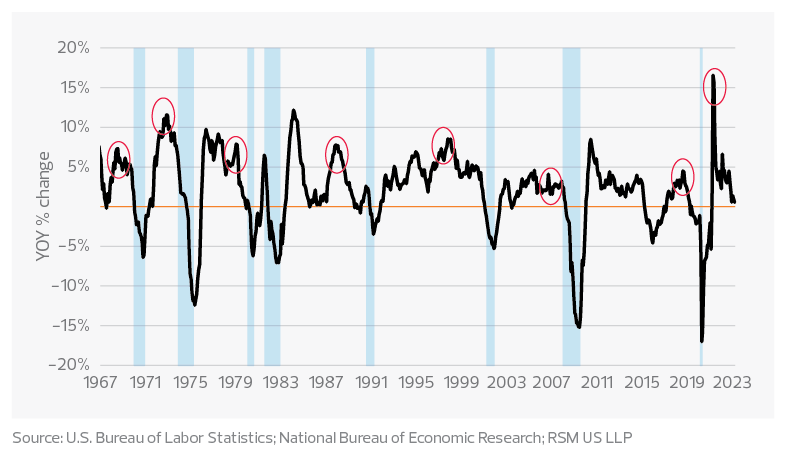

Consider industrial production, an area of the economy that is sensitive to interest rates and grows along with the expansion of the business cycle, but often peaks long before the end of each cycle. At the end of some cycles, industrial production has dropped quickly, but only after the economy has slipped into a recession. Most recently, industrial production had already become contractionary in 2019 before the economy suffered from the 2020 health crisis.

U.S. industrial production at the end of business cycles

While industrial production is still growing, manufacturing sentiment has resided in terrain consistent with a recession for the past four months.

And it is quite clear that the real estate sector—another area of the economy sensitive to interest rates—has been in recession for some time.

So what can we say about the likelihood of this business cycle lasting only a few more months?

To begin with, the Federal Reserve has determined that restoring price stability is in the long-term best interest of the economy. Price stability is a precondition of maximum sustainable employment, and inflation must be reduced to tolerable levels to cool an overheated economy.

The effect of increasing rates by 475 basis points over the past 12 months is finally having an effect on inflation, investment decisions and, increasingly, the labor market. Upcoming economic data on gross domestic product and the personal consumption expenditures index should demonstrate further signs of cooling in the economy.

But with underlying inflation still running somewhere between 4% and 5%, it will be some time before the all-clear signal can be declared on inflation and the policy rate can be cut.

We expect the Federal Reserve to increase its policy rate by 25 basis points at its next meeting on May 3, and do not expect any rate cuts this year.

In terms of a possible wage-price spiral, wages for higher-paying manufacturing jobs have dipped to less than a 5% yearly growth rate in the past two months.

Average hourly earnings that were growing by 7% in March 2022, before the Fed began its rate hikes, have slowed to a 5.1% yearly growth rate, with most of those gains occurring among lower-wage jobs.

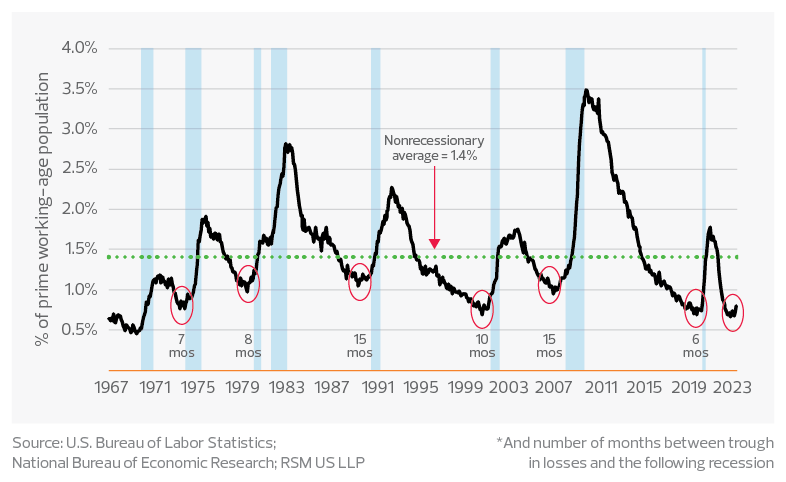

U.S. permanent job losses at the end of business cycles*

In terms of employment opportunities, which indicate the demand for labor and, ultimately, the cost of labor, there are now signs of maturation in the labor market similar to what occurred at the end of each of the business cycles since the 1970s.

As one would expect, the demand for labor increases along with the progression of the business cycle. Increased economic activity results in higher demand for labor and fewer job losses.

But as the business cycle wanes, the demand for labor wanes, and job losses increase. We see this in the months before a recession officially begins.

For instance, in September 2022, the U.S. Bureau of Labor Statistics reported 1.76 million permanent job losses. Six months later, there were nearly 2.12 million permanent job losses.

If anything, the R word that should be used in connection with the American economy should be resilient, not recession.

If this increase in job losses were to persist, that would suggest an increase in the supply of available labor and a reduced need to offer higher wages.

The loss of jobs and the reduction in income imply a growing reluctance to spend on the part of households and businesses and a slowdown in overall economic activity.

We don’t expect this to happen overnight. Businesses will be reluctant to shed workers who were so hard to attract after the pandemic.

There will be sustained demand for labor for the infrastructure programs enacted in 2021–22. And there will be continued government spending on defense outlays and likely additional special supplemental spending bills to support efforts in Ukraine. All these dynamics will stoke industrial production and moderate job losses.

Still, recessions are typically the result of a financial or economic shock that pushes a mature business cycle into recession.

The recent turmoil among small and regional banks will almost certainly result in tighter lending. Small firms obtain roughly 70% of their commercial and industrial loans from these institutions.

This tighter lending, in turn, will place an additional constraint on growth in the real economy in the middle of the year. That also happens to be when the next potential shock—the standoff over raising the nation’s debt ceiling—will most likely take place.

Tighter lending and a bout of financial turmoil caused by the political sector are possible tipping points that could turn a Fed-induced slowdown into a recession.

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Joe Brusuelas and originally appeared on 2023-05-02.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/economics/growth-employment-and-identifying-the-end-of-a-business-cycle.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.