Insights

Oil prices show record volatility in 2020: Path to recovery uncertain

ARTICLE | September 19, 2020

Authored by RSM US LLP

The unprecedented imbalance the oil market has experienced for much of 2020 has garnered extraordinary responses from both oil producers and policymakers. Oil and gas companies have been forced to reposition themselves during the downturn in order to prepare for a comeback.

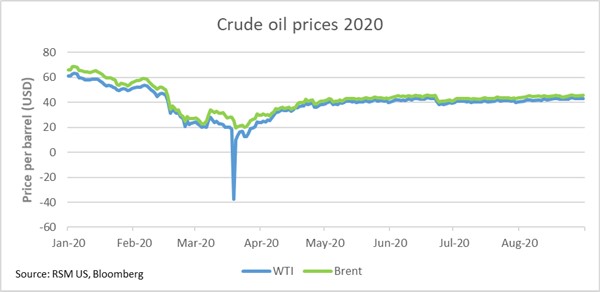

Oil prices in the first half of 2020 were volatile, with West Texas Intermediate plummeting from more than $61 per barrel in January to a historic low of -$37.6 per barrel in April before rising back up to $40 in June. The April price deterioration came on the heels of the OPEC+ deal collapse and a record drop in demand related to pandemic-induced lockdowns. The result was a supply glut combined with limited storage capacity, temporarily making storage space more valuable than the oil itself.

In an effort to relieve storage pressure and balance the market, OPEC+ reached a deal to reduce crude oil production by 9.7 million barrels per day in May and June. Beyond that reduction, U.S. producers dramatically slowed drilling activity and curtailed production, resulting in the largest drop in crude oil production since 1980, according to data from the U.S. Energy Information Administration.

Over the course of May, prices soared nearly 90% to $35 per barrel -- a big jump, but still below breakeven for most producers and not enough to bring production back online. June and July prices held fairly steady around $40 per barrel as OPEC+ agreed to extend production cuts through the end of July. In August, production cuts began to taper but uncertainty around COVID-19-induced demand shocks continued, leaving the door open for the return of market instability.

“I remain optimistic but cautious that the worst is over and a recovery will be in full swing in the second half of this year, with stocks beginning to be withdrawn,” OPEC Secretary General Mohammad Barkindo said in June, in a conversation with the Abu Dhabi International Petroleum Exhibition and Conference. “However, what shape the recovery will take, whether V shape, W or inverted hockey stick, is still uncertain.”

Looking ahead

“North American operators have cut capex by 42%,” according to a June report from Hart Energy, and “rig count has plummeted to less than 300,” a nearly 70% drop since March. The industry has lost approximately 1.3 million jobs, according to Hart’s report.

With oil prices hovering between $40 and $45 per barrel for the last three months and an overall consensus that recovery will be slower than we had hoped for, producers will continue to feel pressure to conserve capital expenditures.

While we wait for this holding pattern to play out, here are some strategies oil and gas companies can employ to emerge even stronger on the other side:

- Be strategic about budget cuts – With slashed budgets, a focus on capital discipline and declining interest from investors, companies should consider the flexibility of their capital investments and cycle time. Those with the ability to cut spending on short-cycle investments and sustain longer-term investments will fare better in the long term. When prices recover, the ability to ramp up the short-cycle assets will still be there.

- Increase focus on sustainability – The COVID-19 pandemic has taught the industry that many foundational elements of environmental, social and corporate governance that support sustainability are key to resilience. A focus on worker safety, environmental stewardship, supply chain diversity and community relationships all position organizations to withstand economic uncertainty. The ESG trend is driven by both investors and the public, and it is here to stay.

- Invest in technology – With the disruption caused by the COVID-19 pandemic also comes an opportunity for businesses to redefine their strategy. In the current market conditions, efficiency and productivity have never been more important. The ability to use data and technology to drive productivity is paramount to these initiatives. Advanced analytics, artificial intelligence, robotics, enterprise cloud solutions, blockchain and other advanced technologies are transforming the way the industry operates by allowing for better processes and increased profits. Sustaining or even accelerating investment in innovative technologies is a game changer in positioning the industry for success as the market recovers.

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Anne Slattery and originally appeared on Sep 19, 2020.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/energy/oil-prices-show-record-volatility-in-2020-path-to-recovery-uncer.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.