Insights

Tax-exempt status in health care

OUTLOOK | May 20, 2022

Authored by RSM US LLP

Hospitals and health care organizations granted tax-exempt status have the benefit of not paying corporate taxes on the income they produce from related business activities. Additionally, many of these organizations receive exemptions from other taxes (e.g., sales and real estate). Achieving and maintaining tax-exempt status requires reporting on a variety of activities, including community benefits and charity care. Accurately calculating these efforts is critical; failure to record compliance in real time might cause scrutiny later. However, performing accurate reporting can be a complex undertaking for many organizations.

Distinguishing tax-exempt status

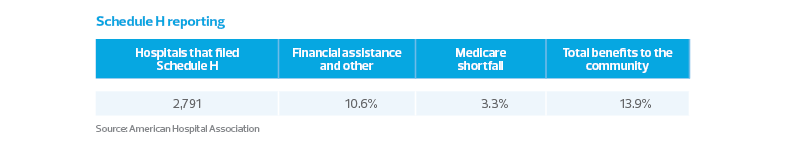

Tax-exempt health care organizations, as described in Internal Revenue Code section 501(c)(3), are required to file Form 990, Return of Organization Exempt From Income Tax, to provide a view of their activities. Some of the most publicized data from Form 990 includes an organization’s executive compensation and, on Schedule H, a hospital’s reporting of compliance with section 501(r).

Schedule H requires data on a hospital’s financial assistance and community benefit programs, including charity care provided and Medicaid shortfall (i.e., the amount of uncompensated costs from treating Medicaid patients). This information is one of the factors that may distinguish tax-exempt hospitals from for-profit hospitals that offer the same medical services. The Court of Appeals for the 10th Circuit, invoking revenue ruling 98-15, held that “not every activity that promotes health supports tax exemption under section 501(c)(3).” The court added that “engaging in an activity that promotes health, standing alone, offers an insufficient indicium of an organization's exempt purpose. Numerous for-profit enterprises offer products or services that promote health.”

Various stakeholders, including Congress, view this reporting responsibility as a burden that tax-exempt health care providers must bear to justify their status. Comparisons of the public records of for-profit hospitals and tax-exempt hospitals contribute to a perception that tax-exempt hospitals need to do more to justify their tax-exempt status. Although no bright line indicates the minimum community benefit a tax-exempt hospital must provide to maintain its section 501(c)(3) status, organizations continue to emphasize the accurate reporting of these amounts, in part to provide interested parties a true depiction of the benefits they provide to the communities they serve.

What should providers do?

For health care providers, it is important to accurately capture and measure the organization’s community benefit and take credit for all its charitable efforts. Tax-exempt hospitals and health care systems should ensure that their reporting on Schedule H and to media outlets is complete and accurate, with every community benefit expense accounted for properly.

Hospitals and health care providers may report on their Schedule H, and in other documents for the public and stakeholders, the impact of meeting the health-need deficits identified through their community health needs assessment. They may also report on their environmental, social and governance efforts. Many constituents are interested in an organization’s formalized policies and programs related to service dedication, environmental protections, social justice efforts and more. An ESG strategy fortifies an organization’s reputation in the community and promotes goodwill. It’s another way to communicate an organization’s core passions, as well as the benefits and support it provides in the community.

While many health care providers can take substantial credit for changing the health care outcomes of their communities, the key to maintaining tax-exempt status lies in telling the story. In addition to providing data points, providers can focus on their impact in the community and other validating factors. The story of community benefits and other charitable efforts should be rigorously and accurately reported.

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Rebekuh Eley, Richard Kes and originally appeared on May 20, 2022.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/health-care/tax-exempt-health-care-trends.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.