Insights

The telehealth explosion has changed health care delivery forever

ARTICLE | September 15, 2020

Authored by RSM US LLP

Before the coronavirus pandemic, Americans might have been more reluctant to try video appointments with their doctors, perhaps uncertain of the quality of care that telehealth would allow. But now, five months into the crisis, necessity has spurred rapid, widespread adoption of telehealth in the United States. If physicians or patients thought video health care appointments were simply a fledgling trend before 2020, plenty of them almost certainly have a different perspective now.

Earlier in the pandemic, news outlets reported that telehealth appointments were soaring. According to research from Fair Health, telehealth claim lines increased by 4,347% nationally, from 0.17% of medical claim lines in March 2019 to 7.52% in March 2020. The Providence Medical Group reported that it experienced an increase from 700 visits a month to 70,000 visits a week after ramping up their telehealth platform in March, as we noted in our health care industry outlook in July. Medicare figures point to skyrocketing use as well: “At least 10 million Medicare beneficiaries have used telehealth since early March,” according to a CNBC article from mid-August.

The rapid expansion of virtual health in the wake of COVID-19 is not contained to the United States. Canadian company WELL Health Technologies reported a 1,200% increase in digital services revenue year-over-year for the second quarter, according to a report from Desjardins Capital Markets. This segment of the company 's health care business grew to 22% of total revenue from just 2% the prior year, per that report.

Even if the telehealth boom is leveling off now compared to March and April, we do not expect telehealth use and investments ever to go back to pre-pandemic levels. Increased capital from investors and pressure on the U.S. Centers for Medicare and Medicaid Services to change its reimbursement rules for telehealth are two indicators that widespread adoption of this service is here to stay.

Investment and regulatory landscape

The adoption of telehealth has long been constrained by the regulatory and reimbursement environment. Physicians, for example, cannot practice across state lines (e.g., a doctor in Minnesota generally cannot treat a patient in New York), and that limit historically has applied to virtual care as well. Health care providers have also criticized the reimbursement framework; a physician cannot be reimbursed for a virtual visit with a patient covered by Medicare unless that physician has previously seen that patient in person.

The pandemic temporarily relaxed such regulatory rules, and we expect, as do others, that some of these rules will be permanently relaxed or revised. Whatever changes may happen with Medicare reimbursement, payors will likely follow suit. Industry stakeholders, including tech investors, are watching closely to see how these regulatory decisions shake out.

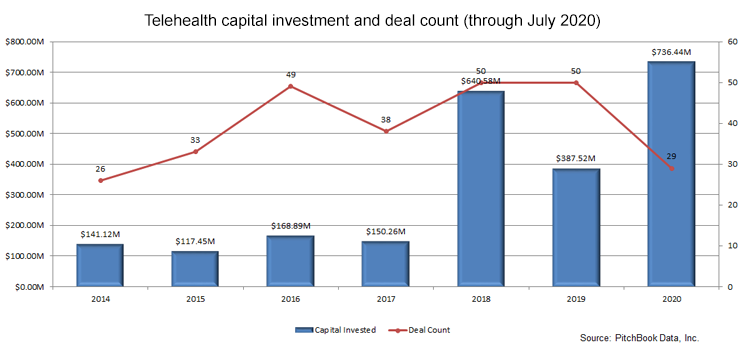

Meanwhile, telehealth is on pace for a record-setting year in terms of both the number of venture capital deals and the capital raised in those deals, according to data from PitchBook. We don 't expect anything in the second half of 2020 that will slow down telehealth deal-making.

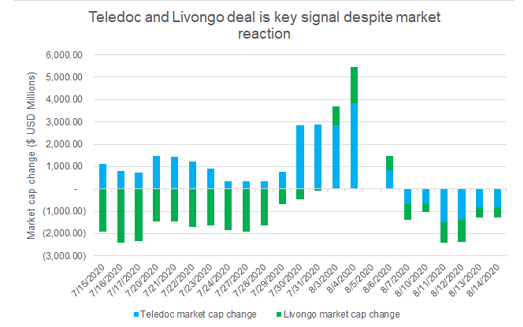

Perhaps the most notable deal in the first half of 2020 was the $15.1 billion acquisition of Livongo by telehealth platform Teledoc. The deal provides strategic synergies between Teledoc and the virtual chronic disease management solutions Livongo offers. Wall Street has questioned the timing of the deal, as the combined companies have lost nearly $1.3 billion in combined market capitalization since the announcement. However, most industry observers view this deal as a way for the combined company to provide expanded services across the continuum of care—an old page out of the health care M&A playbook. That a virtual health provider would deploy $15.1 billion toward this same strategy underscores the rapid maturation of telehealth during the pandemic. Such an enormous deal in what was previously the domain of smaller and more fragmented startups is significant.

The private capital markets have also shown increased activity and deal size. One such example was Amwell 's raising $194 million for its digital health platform. The Boston-based telehealth company was already growing well before the pandemic, and the crisis has only increased patient volume and its platform 's value.

Health care catching up

Like all digital platforms, telehealth platforms have the potential for explosive scalability at little to no incremental cost and with little, if any, loss of service quality. This is something the technology sector innately understands, but an area in which health care has lagged—in some cases, understandably so, because there are medical issues that still require an in-person visit with a doctor, and many patients lack familiarity with telehealth. But just as digital platforms such as Netflix, Amazon and Uber have disrupted other industries, a pandemic-induced upheaval has now arrived for health care.

Providers have criticized virtual care platforms as being expensive technological investments that cannibalize revenue from in-person visits. For example, an urgent care provider might get reimbursed significantly less for diagnosing an ear infection and prescribing antibiotics over a virtual health platform than they might by performing the same service in person.

But players in the health care industry that continue to resist telehealth for such reasons are at risk of being left behind. The health care industry is moving from a fee-for-service model toward value-based care. These value-based models have great potential to align incentives across the industry and promote improved care and outcomes while lowering cost. Such value-based care models will not be successful without virtual health.

This shift requires health care participants to rethink how they go to market. Instead of simply existing in a community or preferred network, they will have to build unique brands and attract patients from diverse backgrounds and geographies, since those patients will no longer have the same travel and time restrictions they once did. This isn 't new for most industries, but it is for health care.

Virtual flexibility

Another adjustment for many health care providers is the flexibility and informality that virtual platforms allow. Many doctors aren 't used to having the capability to work from home, and doing so now is not just a matter of convenience; video visits can also help reduce COVID-19 exposure risks for front-line workers such as nurses and other medical office staff.

Telehealth has been especially helpful during the pandemic to reach patients in rural areas, and virtual platforms for medical care have long been touted as an access solution in more isolated locales. And virtual care isn 't just about connecting people to their longtime doctors; the pandemic has also resulted in greater adoption of newer platforms such as 98point6, which provides text-based primary care on demand.

It is important to acknowledge that telehealth services still have plenty of room for improvement. With time, we expect patient satisfaction with telehealth to improve and clinicians to streamline their processes for balancing virtual visits with in-person appointments and adapt to using the electronic health record documentation for both. There are still access barriers for patients who may not have access to the internet or digital devices needed to use telehealth platforms. The rapid expansion of telehealth also brings heightened concerns around patient privacy and data security.

Building a long-term strategy

As the pandemic has worn on, it has become clear that health care providers and companies in the tech sector that enable telehealth services need to map out long-term strategies for such services. The slap-dash approach of rapidly scaling up virtual care offerings when they were needed most in March and April is not a sustainable business model for the future. RSM 's rapid assessment evaluations can help businesses develop these long-term strategies and understand risks that need to be addressed.

Now that many states are allowing elective procedures to take place again, telehealth volumes are down from where they were a few months ago. While use of these platforms may have declined from that peak, we do not expect utilization ever to return to January 2020 levels. As people have been forced to use virtual care services, patient and physician resistance has largely faded, and this change is here to stay.

This content was originally published on RSMUS.com.

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Matt Wolf, Kurt Shenk, Jessika Garis and originally appeared on Sep 15, 2020.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/life-sciences/telehealth-explosion-changed-health-care-delivery-forever.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.