Insights

U.S. April Consumer Price Index: Peak inflation provides no solace

REAL ECONOMY BLOG | May 11, 2022

Authored by RSM US LLP

About the best one can say about the April inflation report is that year-over-year metrics appear to have topped while core inflation increased, and housing costs that are up 6.5% from a year ago are now a policy issue that needs to be addressed.

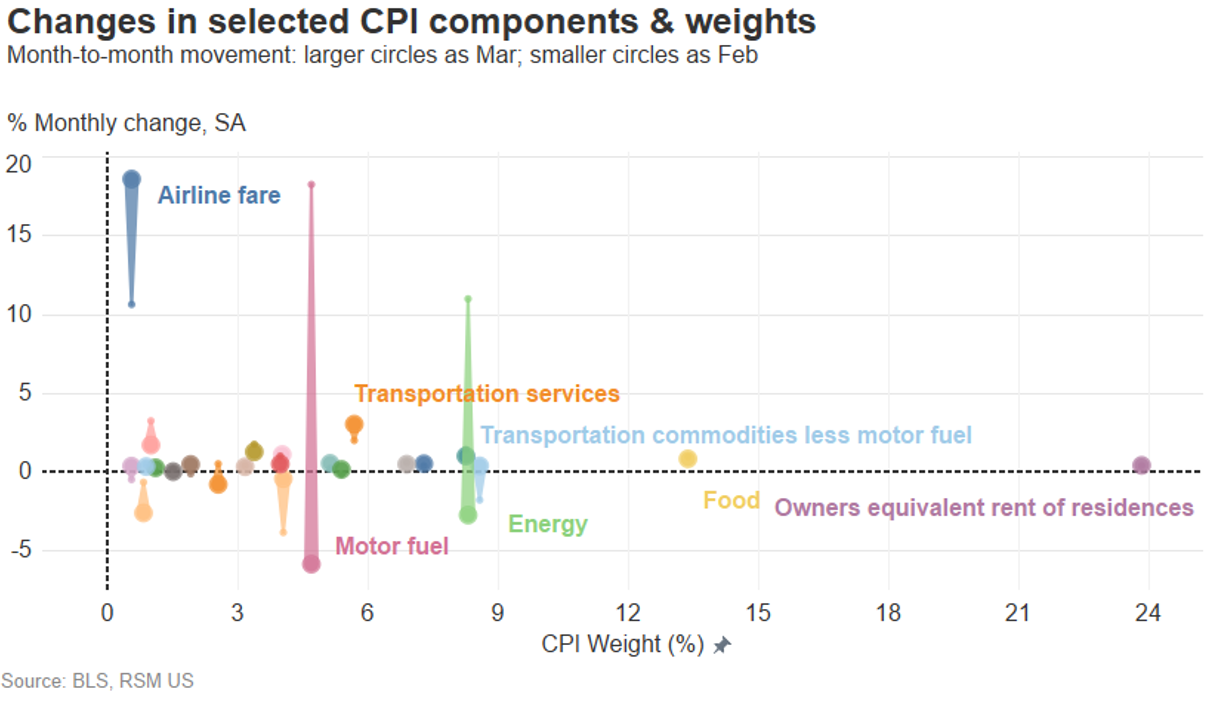

The data inside the report reflects a shift in demand from goods to services, which caused demand for airline transportation services to increase a whopping 33.3% from a year ago.

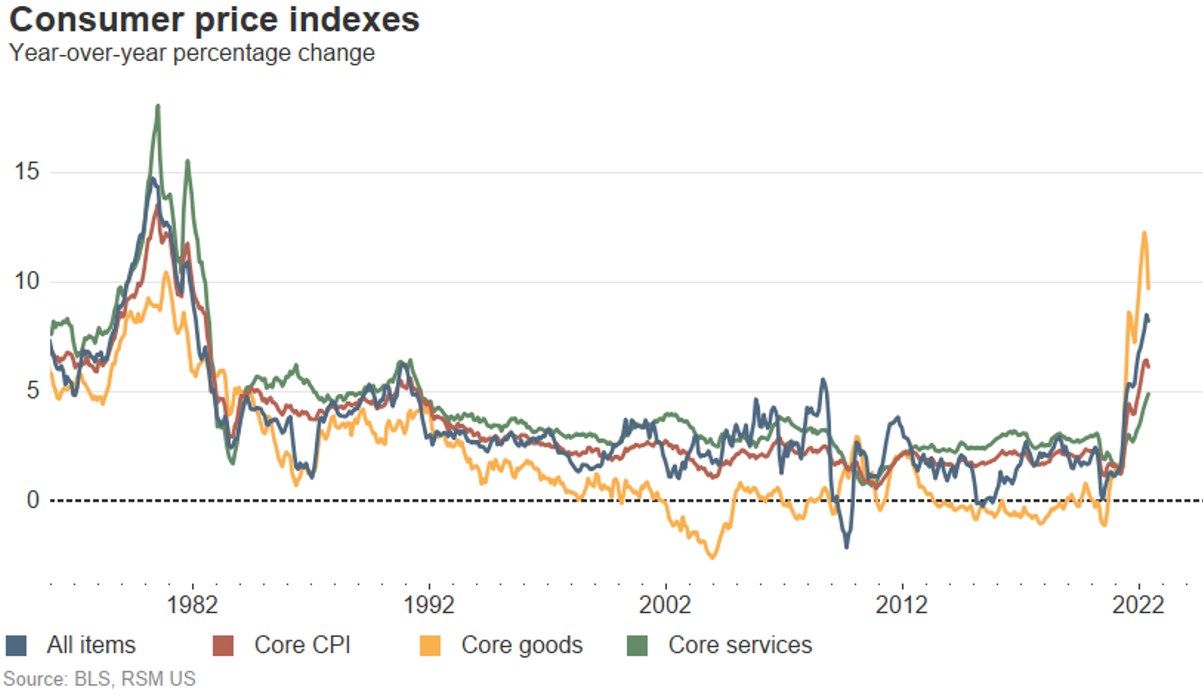

Top-line inflation declined to 8.3% in April, down from 8.5% in March, as core prices, which exclude food and energy, rose by 6.2% from a year ago.

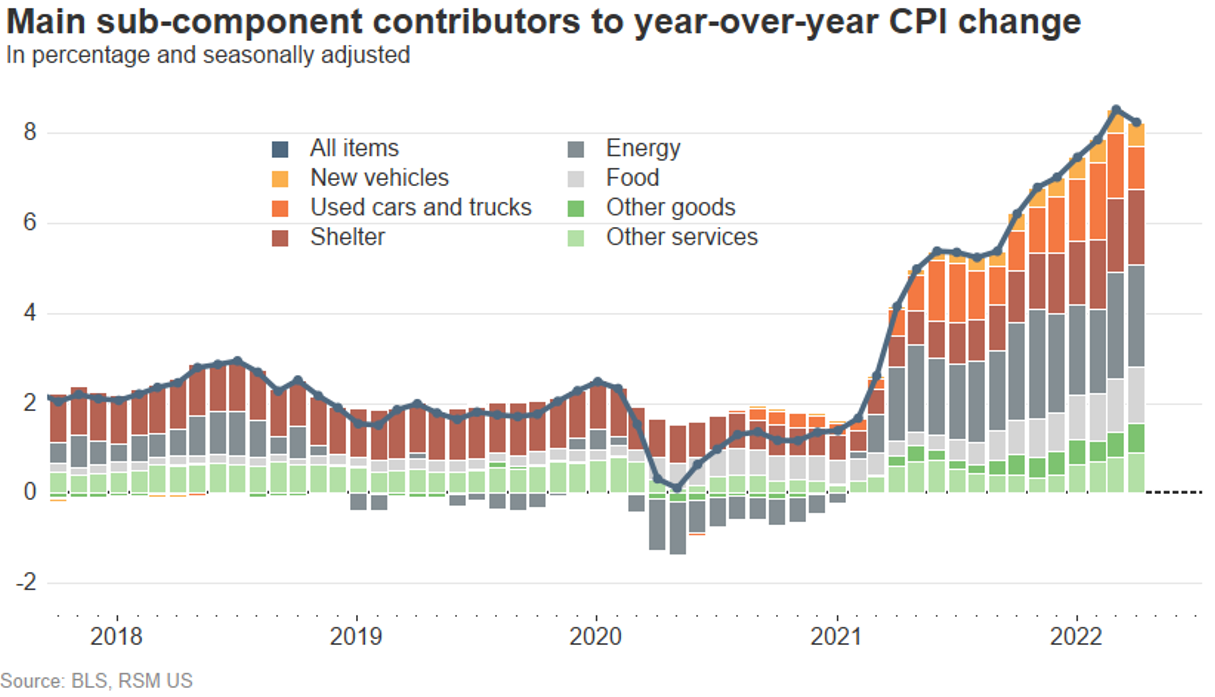

Inflation in this business cycle most likely reached its zenith in March as transportation prices and other industrial goods declined in April relative to year-ago levels. The result was an easing of top-line inflation to 8.3% in April from 8.5% in March.

But one does not get the sense that this is going to provide any relief to households experiencing a loss in purchasing power and to policymakers who will attempt to restore price stability without causing a recession.

Core prices, which exclude food and energy, increased by 0.6% in April and were up by 6.2% from a year ago. Those costs where buttressed by a 0.5% increase in shelter and the policy-sensitive owners’ equivalent rent series. The former is now up by 5.1% from a year ago and the latter has increased by 4.8%.

The number that jumps out in the core data was the 18.6% increase in airline fares. In addition, the 1.1% increase in new vehicles induced some distortion into the series as the Bureau of Labor Statistics introduced a new methodology in estimating those costs in April.

Where there was improvement, it was inside the energy complex, which declined by 2.7% on the month, which followed the February and March price shocks of the war in Ukraine. Used car and truck costs declined by 0.4%.

Risks to the outlook

While inflation may have peaked, the twin shocks of the war in Ukraine and the reemergence of the coronavirus in China have the potential to prolong an increase in food and energy prices that will put at risk well-anchored medium- to long-term inflation expectations.

These price shocks will have the greatest effect on lower-income households, reducing their propensity to spend and causing a slowdown in economic growth that will eventually affect all income classes and businesses.

More important, gasoline prices are rising again and will almost certainly continue to do so until the summer driving season peaks around the July 4 holiday.

Perhaps more important, the 0.9% rise in food and 0.8% increase in food and beverages, which are up by 9.4% and 9%, respectively, have plenty of room to increase as the drop in exports from Ukraine and Russia affect prices this year.

It’s important to remember that American households tend to define inflation through food and fuel prices, so this data will be more important in the near term despite what will be an almost mechanical drop in top-line inflation as the data series moves away from supply chain shock-induced levels of a year ago.

Policy implications

The April inflation data underscores the sense of urgency at the Federal Reserve to restore price stability. In fact, this data will almost certainly set the stage for the Fed to push the policy rate up another 200 basis points to 3% this year from the current rate of between 0.75% and 1%.

Unfortunately, this data reinforces the idea that the Fed can do little to nothing around the supply side issues and idiosyncratic risks to the inflation outlook. That leaves the Fed little choice but to drop the hammer of rising interest rates on American households that are still adjusting to a series of shocks over the past two years.

The data

Energy and commodity costs declined by 5.4% in April while gasoline prices dropped by 6.1%, Apparel prices declined by 0.8%, education costs increased by 0.2% and commodities excluding food and beverage costs declined by 0.9%. Medical costs increased by 0.4% on the month and by 3.2% from a year ago.

The service sector, which comprises most of the U.S. economy, experienced a 0.8% increase in April and was up by 5.4% from a year ago. Service sector prices excluding energy advanced by 0.7% on the month and were up by 4.9% year over year.

Inside the food complex, food at home jumped by 1% and cereal and bakery products were up by 1.1%. Meats, poultry, fish and eggs prices increased by 1.4%; dairy and related products advanced by 2.5%; and fruits and vegetables prices declined by 0.3%. Non-alcoholic food and beverages jumped by 2% while food away from home increased by 0.6%.

The takeaway

Inflation will almost certainly be choppy in the near term even as goods prices ease from year-ago levels. The shift in demand from goods to services, which is on clear display inside the April report, will drive the summer narrative as Americans venture out to enjoy travel.

Core inflation, which is now capturing the sharp rise in the cost of housing that has roughly a 40% weight inside the report, will remain somewhat stubborn inside the Consumer Price Index.

This is the type of inflation that we are far more worried about over the medium- to long-term given the shortage of supply in the housing market over the past decade and the inability of local policymakers to overcome the not-in-my-backyard resistance to easing that shortage.

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Joseph Brusuelas and originally appeared on 2022-05-11.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/u-s-april-consumer-price-index-peak-inflation-provides-no-solace/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.