Insights

U.S. May jobs report: Robust gains in total employment as wage increases ease

REAL ECONOMY BLOG | June 03, 2022

Authored by RSM US LLP

American firms continued to hire workers at a torrid pace in May to meet strong demand amid a historically tight labor market and 8.3% inflation.

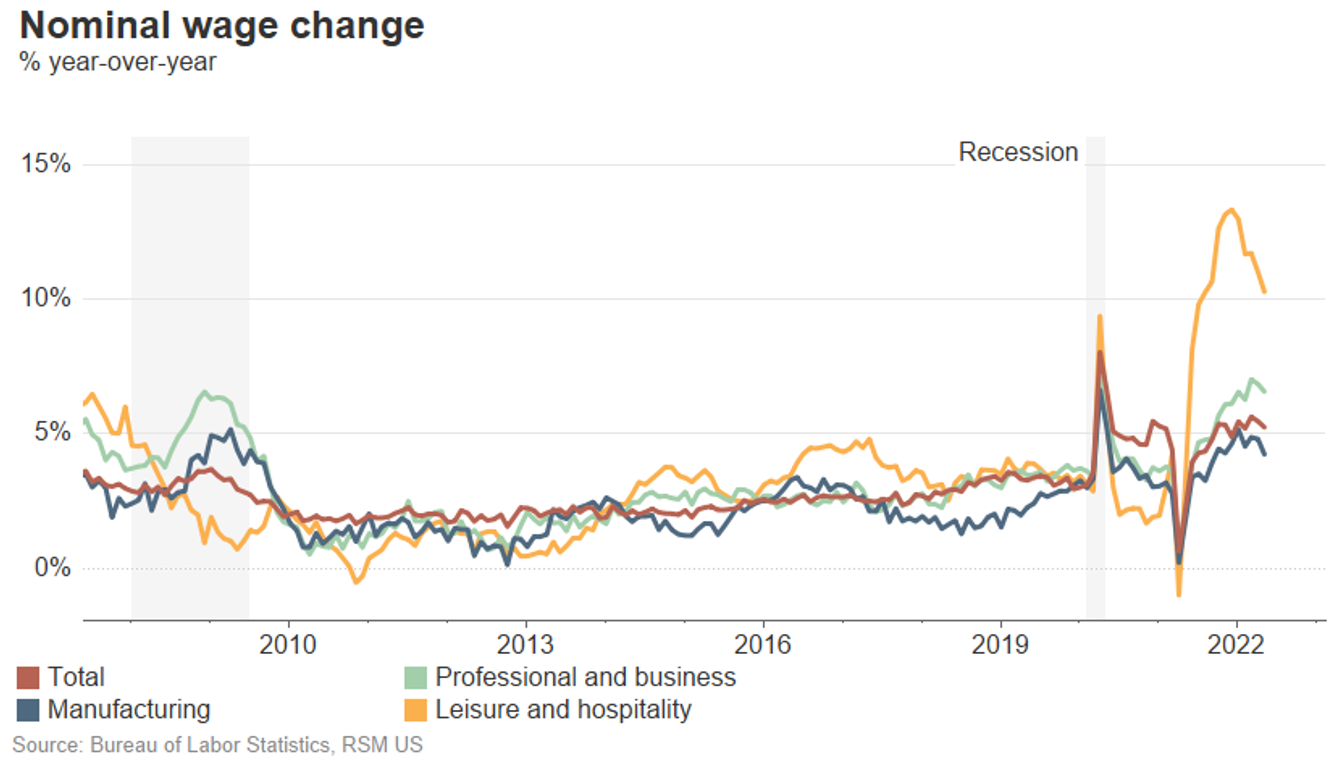

Amid that robust increase in total employment of 390,000 in May, the three-month average annualized pace of average hourly earnings slowed to 4.3% on the month from 4.4% in April and from 6.1% in January, according to Labor Department data released Friday.

While this jobs report will provide much-needed relief to policymakers at the Federal Reserve as they work to restore price stability, this is no time to get complacent.

In our estimation, this is likely going to be the last robust employment report in this business cycle. The delayed impact of past rate hikes is beginning to arrive with an observable slowing of hiring in the rate-sensitive areas of manufacturing, trade and transport, and goods-producing industries, as well as in finance. All of these are higher-paying ecosystems inside the American economy.

Given what was clearly an overheating economy during the final quarter of last year, this jobs report represents a step in the right direction toward restoring price stability, which right now is the paramount policy objective out of Washington.

Still, we do not expect the Federal Reserve to back off what we expect to be 50 basis-point hikes in the federal funds policy rate in June and July, with the possibility of another in September.

In addition, we expect the policy rate to move into restrictive terrain, above 2.5%, before the end of the year, which will create the conditions for further cooling in the labor market that will almost certainly slow down to gains of 200,000 per month in the near term.

Beneath the headline

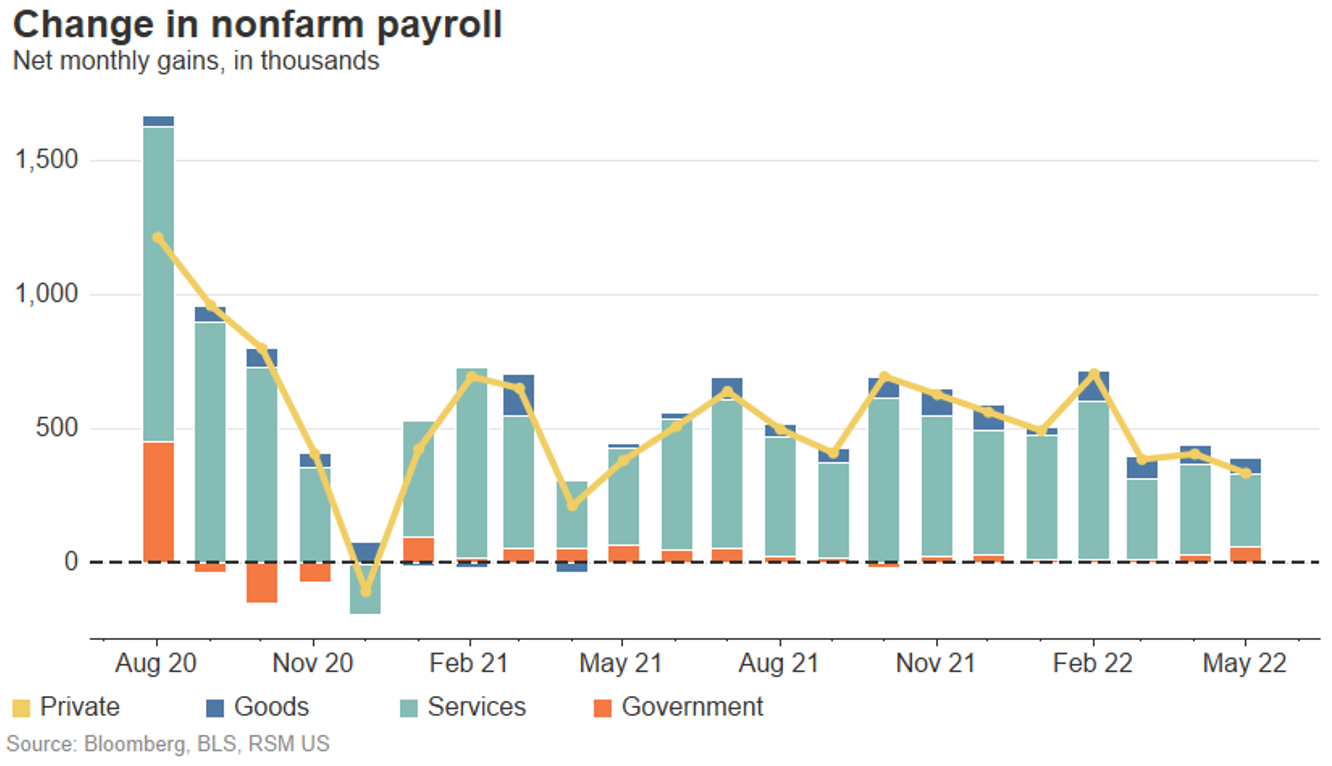

Perhaps the most encouraging development inside the May jobs report was a noticeable slowing in private-sector hiring to a pace of 333,000 from 405,000 previously and 704,000 in February.

The unemployment rate held at 3.6% as the labor force participation rate inside the household survey increased to 62.3% from 62.2% in April. The employment-to-population ratio increased to 60.1% and the median duration in unemployment increased to 9.6%, which almost certainly reflects the freezes in hiring that occurred during the May sampling period.

Aggregate hours worked increased by 3.3% on a three-month average annualized pace, which is below the 4.2% increase previously and well below the 6% posted in January.

Hiring in goods-producing eased to a gain of 59,000 from 69,000, while hiring in manufacturing slowed to 18,000 from 61,000 in April. Construction advanced by 36,000 after no change previously. Trade and transport increased by 1,000 following the 81,000 gain previously. Retail trade contracted by 61,000.

Hiring in information and finance advanced by 16,000 and 8,000 respectively. One of the stronger areas of hiring was in business services, where 75,000 people returned to the labor force, and in education and health, which jumped by 74,000 in May. Gains in leisure and hospitality increased by 84,000 and government hiring increased by 57,000.

The takeaway

Hiring remains robust, and labor is benefiting from solid wage gains, which will continue to bolster spending and most likely keep the economy out of a recession in the near term.

But one can observe a residual slowing in hiring across most rate-sensitive sectors, and the pace of wage gains on a three-month average annualized pace is easing. While that implies coming relief on top-line inflation and the likely avoidance of a wage-price spiral, it is not the type of clear and convincing evidence necessary to cause the Federal Reserve to back off its plans to hike the policy rate.

For now, gasoline and food costs continue to rise, and Americans will find little solace in these numbers, in contrast with the forward-looking investors, policymakers and economists who will.

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Joseph Brusuelas and originally appeared on 2022-06-03.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/u-s-may-jobs-report-robust-gains-in-total-employment-as-wage-increases-ease/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.