A remote auto parts dealer was found to have physical presence nexus due to the activities of in-state distributors.

A remote auto parts dealer was found to have physical presence nexus due to the activities of in-state distributors.

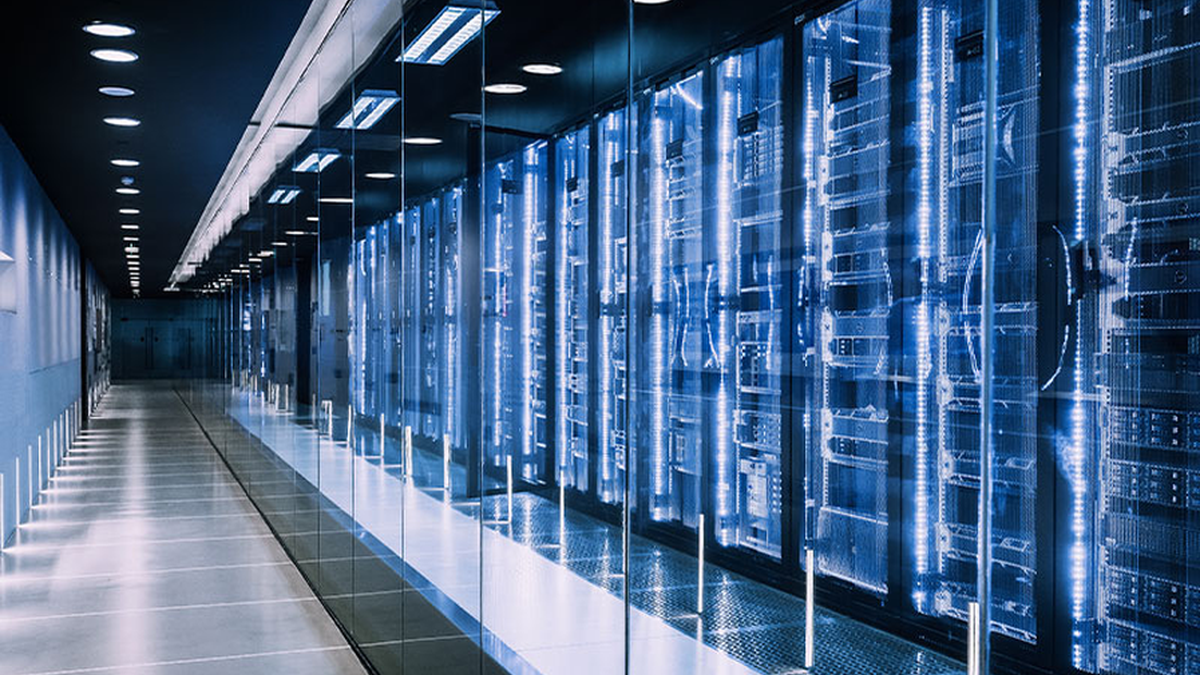

The latest best practices guide outlining the strategic approach needed to drive growth, efficiency and innovation through disciplined IT infrastructure modernization.

Explore recent GASB updates, gain insights into implications, and receive strategic implementation guidance in this webcast.

Tax law and financial reporting considerations for first quarter 2024 tax provisions accounted for under ASC 740.

Learn how industrial companies are using technology to bolster global supply chain.

State and local income tax updates enacted during the quarter ending March 31, 2024, which may impact current and deferred tax provisions.

Learn about the challenges nonprofit organizations face and how leveraging technology can help.

Biopharmas have options to reduce cost profiles of research and development materials. This can help improve cash flow.

IRS postpones various tax filing and tax payment deadlines for Hawaii fire victims.

Profits interest are an equity-based compensation device intended to incentivize key employees in partnerships.