Insights

Featured Insights

No results found.

No results found.

All Insights

Content Type:

Industry:

- All

- Automotive

- Business and Professional Services

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Education

- Energy

- Financial Services

- Food Beverage

- Gaming

- Government

- Government Contracting

- Government Public Sector

- Health Care

- Healthcare

- Hospitals and Health Systems

- Life Sciences

- Manufacturing

- Media & Entertainment

- Nonprofit

- Private Clubs

- Private Equity

- Professional Services

- Real Estate

- Restaurant

- Retail

- Tech Media Telecom

- Technology Industry

- Telecommunications

Service:

- All

- Accounting

- Audit

- Auditing

- Business Applications

- Business Tax

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data Digital Services

- Digital Transformation

- Employee Benefit Plans

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Consulting

- Financial Management

- Global Services

- Internal Audit

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Outsourced Solutions

- Private Client Services

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- State and Local Tax

- Tax

- Technical Accounting Consulting

- Technology and Digital

- Technology Consulting

- Technology Risk

- Transaction Advisory

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Blockchain

- Business Growth

- CARES Act

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Digital Evolution

- Distressed Real Estate

- Economics

- Election

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Financial Reporting

- Inflation

- Innovation

- International Standards

- Labor and Workforce

- Lease Accounting

- Opportunity Zones

- Payroll and Employment

- PCAOB Matters

- Pillar Two

- Policy

- Regulations and Compliance

- Regulatory Compliance

- Revenue recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- Supply Chain

- Technology and Data

AI buy vs. build: What is the right approach for your organization?

AI buy vs. build: it's a key issue that many companies often struggle with when developing their AI strategy.

Estate planning in 2025: What you can do now

Estate planning strategies for uncertainty. Proactively build flexibility into your plans. Secure your legacy amidst tax changes. Learn how now.

Navigating value-added tax implications for e-commerce businesses

Countries have varying VAT rates, registration thresholds and compliance requirements, making diligence essential for businesses.

Accounting Today Recognizes Vasquez + Company LLP as a 2025 West Coast Regional Leader

Vasquez + Company LLP has been named a 2025 West Coast Regional Leader by Accounting Today for the second consecutive year, recognizing the firm’s continued growth and industry leadership. This achievement reflects Vasquez’s commitment to excellence, innovation, and high-quality client service.

Your Guide to Reporting Digital Assets Transactions on 2024 Tax Returns

Discover how to navigate the complex world of digital asset taxation in 2024. This guide explores how the IRS classifies and taxes assets like Bitcoin and NFTs, offering insights on reporting gains, avoiding penalties, and staying compliant. Dive in to protect your investments and ensure your tax return accurately reflects your digital transactions.

Are You Ready for the 2025 REAL ID Deadline?

Starting May 7, 2025, travelers will need a REAL ID-compliant license or an approved alternative to fly domestically or enter certain federal facilities. The REAL ID Act, stemming from post-9/11 security changes, requires enhanced ID standards, affecting millions of Americans. Don’t get caught unprepared—learn what you need to ensure a hassle-free travel experience.

How to Optimize Your Tax Situation Before the 2025 Deadline

Prepare for the 2025 tax deadline by exploring key strategies to potentially lower your 2024 federal income tax liability. Discover the benefits of HSAs, deductible IRAs, and navigating SALT options, along with insights into medical expense deductions and casualty loss claims. Equip yourself with these tips to optimize your tax situation and minimize your overall responsibility.

Strategic Earnings Management: Understanding Accumulated Earnings Tax

Discover the intricacies of the Accumulated Earnings Tax (AET) and how it affects C corporations trying to balance growth and tax efficiency. This article explores triggers, consequences, and strategies for AET management, providing valuable insights on tax planning to minimize penalties while maximizing business potential. Dive into the differences between AET and the Personal Holding Company tax to ensure your corporation stays compliant and financially sound.

Last-Minute Tax Moves for 2024: A Guide for Small Businesses

As tax season approaches, small business owners have various last-minute strategies at their disposal to manage and potentially reduce their 2024 tax liabilities. From understanding key filing deadlines to leveraging deductions like the Qualified Business Income deduction and Section 179 depreciation, this guide explores proactive steps that could significantly impact your tax position. Discover how acting swiftly and strategically can set you up for success in the upcoming tax year.

How to Reduce Taxes and Enhance Retirement Savings Before the 2025 Deadline

Navigating post-year-end contributions can still help you decrease your 2024 tax bill and boost retirement savings. From IRAs to small-business retirement plans like SEP IRAs and profit-sharing plans, discover strategies for maximizing deductions this tax season. Explore which plan suits your needs and deadlines to ensure an optimal financial future.

Understanding Your COBRA Obligations as an Employer

Navigating COBRA compliance can be complex, yet it plays a critical role in safeguarding employee health benefits during transitions like job loss or reduced hours. This article breaks down essential COBRA requirements for employers, emphasizing the importance of timely communication and organized processes to prevent legal pitfalls and foster workforce goodwill. Discover how upholding these obligations can protect your organization and support your employees in times of change.

Safeguarding Your Business: The Dangers of Mishandling Payroll Taxes

Mishandling payroll taxes can lead to dire consequences, including personal liability for business owners and key personnel. Discover how these liabilities arise, the serious repercussions of neglect, and proactive steps you can take to avoid falling into the payroll tax trap. Stay informed to protect your business's financial health and reputation.

From Forgotten Drawers to Financial Discoveries: Your Guide to Hidden Wealth

Uncover the potential hidden wealth in forgotten financial accounts. This article guides you through reclaiming lost assets, highlights the importance of proper documentation, and offers tips to keep your finances organized and accessible. Dive in to prevent future financial mysteries and turn nostalgic discoveries into real financial gains.

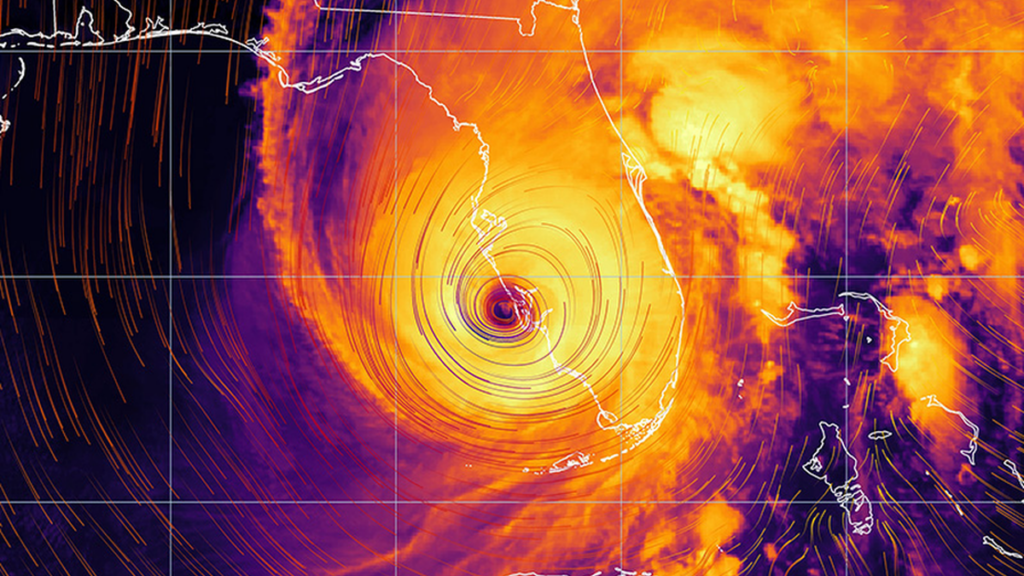

Who’s who in insurance claims for natural disasters

Understanding the parties involved with insurance claims for natural disasters can eliminate ambiguity and increase the speed and success of claims.

Mitigating material weaknesses through effective IAM strategies

With material weaknesses related to evolving technology increasing, companies should evaluate digital identity management strategies to address risks.

No results found.