Insights

Featured Insights

No results found.

All Insights

Content Type:

- All

- AML and Compliance News

- Article

- Audio

- Audiocast

- Careers

- Case Study

- E Book

- E-Book

- Event

- Financial Reporting Insights

- Guide

- Infographic

- Insight Article

- Live Webcast

- Monthly Market Commentary

- Muse

- News Release

- Newsletter

- On Demand Webcast

- Outlook

- Perspective

- Real Economy Blog

- Recorded Webcast

- Research

- Senior Living Health Care Connection

- Special Report

- Tax Alert

- Tax Blog

- The Real Economy

- Video

- Virtual event

- White Paper

Industry:

- All

- Asset management

- Automotive

- Brokerage and Trading

- Business and Professional Services

- Business Services

- Colleges and Universities

- Construction

- Consumer Goods

- Consumer Products

- Education

- Energy

- Financial Institutions

- Financial Services

- Fintech

- Food and Beverage

- Food Beverage

- Fund Services

- Gaming

- Government

- Government Contracting

- Government Public Sector

- Health Care

- Healthcare

- Hedge Funds

- HIPAA HITECH Compliance

- Hospitality

- Hospitals and Health Systems

- Insurance Industry

- Life Sciences

- Long Term Care

- Manufacturing

- Media & Entertainment

- Nonprofit

- Portfolio Services

- Private Clubs

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- REITS

- Restaurant

- Retail

- Specialty Finance

- State and Local

- Tech Media Telecom

- Technology Companies

- Technology Industry

- Telecommunications

- Tribal Gaming

Service:

- All

- Accounting

- Audit

- Auditing

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Business Valuation

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Due Diligence

- Employee Benefit Plans

- Employer Benefits

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Finance and Accounting

- Financial Advisory

- Financial Consulting

- Financial Investigations

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Global Compliance and Reporting

- Global Services

- Governance, Risk and Compliance and Enterprise Risk Management

- Indirect Tax

- Infrastructure

- Internal Audit

- International Services

- International Tax Planning

- Investment Advisory

- IPO Readiness

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- Sarbanes-Oxley Advisory

- SEC

- Security and Privacy

- Service Organization Control Assurance

- State and Local Tax

- Strategy and Management Consulting

- Strategy Execution

- Tax

- Tax Function Optimization

- Technical Accounting Consulting

- Technology and Digital

- Technology Consulting

- Technology Risk

- Trade Advisory Services

- Transaction Advisory

- Washington National Tax

- Wealth Management

Topic:

- All

- Affordable Care Act

- AICPA Matters

- Anti-money Laundering

- Apportionment

- Artificial Intelligence

- ASC 842

- Automation

- Base Erosion and Profit Shifting (BEPS)

- Blockchain

- Board Insights

- Bonus Depreciation

- Brexit

- Business Growth

- Buying Patterns

- Capital

- Career Blog

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Credit impairment

- Cryptocurrency

- Customer Experience

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Digital Evolution

- Digital Goods

- Digital Transformation

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- Enviromental Social Governance ESG

- ESG

- Exempt Organizations

- FATCA

- Financial Reporting

- Fund Management

- Global

- Global Compliance

- Global Expansion

- Going public

- IFRS

- Inflation

- Innovation

- International Standards

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Nexus

- Online and Remote Seller Sales Tax

- Operations

- Organic

- Owner

- Partnership

- Payroll and Employment

- PCAOB Matters

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue recognition

- Risk and Opportunity

- Risk Management

- S Corporation

- SALT Compliance

- SEC Matters

- SPAC Special purpose acquisition companies

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

- Trade and Tariffs

- Vendor Third Party

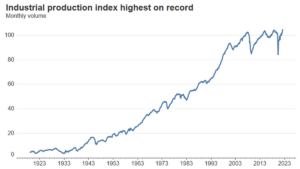

Chart of the day: Industrial production hits record in March

Domestic industrial production increased by 0.9% in March, beating market forecasts despite global supply chain disruptions of key materials.

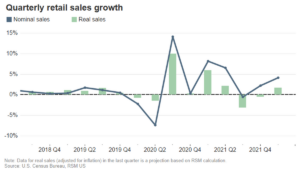

Retail sales slow in March as inflation takes a toll

March's retail sales added substantial downside risks to our forecast for economic growth that will most likely dip below 1% in the first quarter.

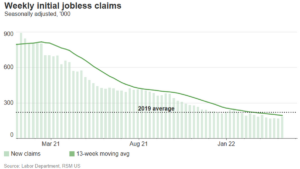

Initial jobless claims remain low as consumer sentiment rises unexpectedly

Initial jobless claims last week rose to 185,000 yet remained significantly below the pre-pandemic level. At the same time…

Proposed rules would include certain market participants as “dealers”

Proposed SEC rules would further define what it means to be buying and selling securities “as a part of a regular business.”

SEC proposes rules regarding security-based swap execution facilities

The SEC has proposed rules to create a regime for the registration and regulation of security-based swap execution facilities.

Accounting for obligations to safeguard crypto-assets

SAB 121 includes guidance for entities that have obligations to safeguard crypto-assets held for their platform users.

Back-office transformation

Maximize value in your post-merger business through people, process, technology and data transformation for your back-office functions.

Domestic producer prices rose 11.2% in March amid Ukraine war

The producer price index for final goods and services rose 11.2% from a year ago, posting double digit growth for the third month in row. For March alone…

The illusion of inventory and price controls in the current economy

Disruptions of supply chains have renewed calls for political authorities to do something about soaring prices. Is this the time for price controls? No.

Beware of traps with paid time off policies

Some common paid time off (PTO) policy features cause taxable income to unexpected parties at unexpected times. Learn more here.

9 frequently asked questions about phantom stock plans

RSM identifies nine frequently asked questions (FAQs) about phantom stock plans, an incentive compensation tool.

ASC 740: Q1 2022 Provision Considerations

A roundup of global income tax considerations and changes in tax law for corporations preparing income tax provisions under ASC 740 for the first quarter of 2022.

SAS 136: Changes to the auditor’s report

For employee benefit plans subject to ERISA, Statement on Auditing Standards No. 136 changes the look of the auditor's report.

White House releases budget; Treasury releases FY 2023 Greenbook

Treasury Greenbook highlights fiscal year priorities of the Administration. It includes $2.5 trillion in revenue proposals and continues the theme of increases in high-income and corporate taxation.

The Best in Employee Benefit Plan Reporting

At Vasquez & Company LLP, we see the importance of having a credible business advisor and partner to evaluate your organization’s efficiencies and fiscal fitness for future operations.